In the ever-evolving landscape of the financial markets, staying on top of the latest trends and indicators is crucial for investors and traders alike. As we navigate through an environment marked by uncertainty and volatility, one key theme that continues to dominate the discourse is sector rotation. Understanding how different sectors of the economy are performing relative to one another can provide valuable insights into market sentiment and potential investment opportunities.

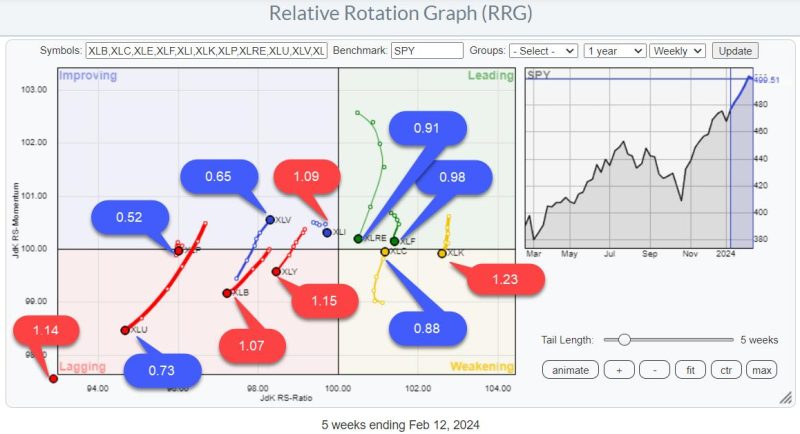

The recent market dynamics have demonstrated a mixed bag of signals when it comes to sector rotation. While the overall uptrend remains intact, there are signs of hesitation and divergence within specific sectors. This highlights the importance of taking a nuanced approach to portfolio management and being mindful of the underlying trends driving market movements.

One sector that has been a focal point of attention is the technology sector, which has been a driving force behind the market rally in recent years. However, there are indications that investors are starting to rotate out of tech stocks and into other areas such as industrials and financials. This shift in sentiment could be driven by concerns over valuations and the potential for a rotation into more cyclical sectors as the economy continues to recover.

Another sector worth watching is healthcare, which has traditionally been seen as a defensive play in times of market uncertainty. However, recent performance has been lackluster, with investors showing a preference for more growth-oriented sectors. This divergence underscores the need for a diversified portfolio that can weather different market conditions.

Overall, while the uptrend in the market remains intact, investors should proceed with caution and pay close attention to sector rotation signals. Diversifying across sectors and asset classes can help mitigate risk and take advantage of emerging opportunities. By staying informed and adaptable, investors can navigate the complex market environment and position themselves for long-term success.