In the world of trading and investing, managing risk and defining trends are crucial components for success. One powerful tool that traders frequently use to achieve these objectives is the ATR Trailing Stop. This innovative method combines the Average True Range (ATR) indicator with a trailing stop, providing a dynamic approach to risk management and trend identification.

The ATR Trailing Stop operates by adjusting the stop-loss level based on the range of price movements. The Average True Range indicator calculates the average range between the high and low prices over a specified period. By incorporating this volatility measure into the trailing stop mechanism, traders can account for fluctuations in price and adjust their risk exposure accordingly.

One of the key benefits of the ATR Trailing Stop is its ability to adapt to changing market conditions. Traditional static stop-loss orders may be too rigid and fail to account for market volatility. In contrast, the ATR Trailing Stop automatically adjusts the stop level based on the current market environment, allowing traders to limit downside risk while giving their trades room to breathe.

Moreover, the ATR Trailing Stop is particularly useful for trend-following strategies. By setting the trailing stop at a certain multiple of the ATR value, traders can ride the trend while protecting their profits. When the price moves in favor of the trade, the stop-loss level trails behind, locking in gains as the trend progresses. This feature enables traders to stay in winning trades longer and maximize their profits.

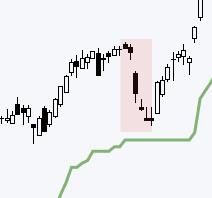

Furthermore, the ATR Trailing Stop can help traders define the prevailing trend in the market. By observing the relationship between the price and the trailing stop level, traders can gauge the strength and direction of the trend. If the price consistently stays above the trailing stop, it indicates an uptrend, while a price below the stop suggests a downtrend. This simple yet effective technique provides traders with a clear framework for trend analysis.

To implement the ATR Trailing Stop successfully, traders should first determine the appropriate ATR period and multiplier based on their trading style and risk tolerance. They can experiment with different combinations to find the optimal settings that suit their objectives. Additionally, traders should regularly monitor and adjust the trailing stop level as the trade progresses to reflect changes in volatility and market conditions.

In conclusion, the ATR Trailing Stop is a dynamic tool that can enhance risk management and trend identification in trading. By combining the ATR indicator with a trailing stop mechanism, traders can effectively control risk, capitalize on trends, and optimize their trading performance. Whether used for short-term trades or long-term investments, the ATR Trailing Stop offers a versatile and reliable approach to navigating the financial markets.