Energy: A Long-Term Turnaround in Relative Strength is Brewing

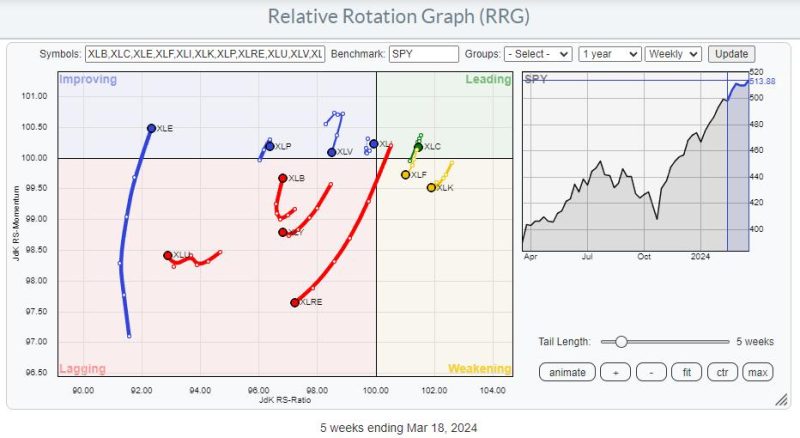

In the realm of investing, the energy sector has long been a source of both optimism and caution for traders and analysts alike. Recent market trends have shown a significant shift in the relative strength of energy stocks, indicating a potential long-term turnaround on the horizon.

Historically, the energy sector has been closely tied to global economic conditions and geopolitical events. Fluctuating oil prices and changing government regulations have made energy stocks a volatile investment choice. However, recent data suggests that this sector may be primed for a resurgence in relative strength.

One key indicator of this potential turnaround is the increasing demand for alternative energy sources. As concerns about climate change and environmental sustainability continue to grow, investors are turning their attention to renewable energy companies. This shift in focus has led to a surge in the market value of solar, wind, and hydrogen energy producers.

Additionally, advancements in technology have paved the way for more efficient energy extraction and production methods. Companies in the traditional energy sector are investing heavily in innovations such as fracking, offshore drilling, and carbon capture technology. These developments are not only reducing production costs but also expanding the potential for growth in the energy industry.

Furthermore, recent geopolitical events have underscored the importance of diversified energy sources. Ongoing tensions in oil-rich regions like the Middle East have highlighted the vulnerability of relying too heavily on fossil fuels. As a result, countries and companies alike are diversifying their energy portfolios to include a mix of traditional and renewable sources.

While the energy sector still faces challenges such as regulatory uncertainties and market volatility, the overall outlook appears optimistic. Investors who recognize the shifting landscape of energy production and consumption stand to benefit from the potential long-term turnaround in relative strength.

In conclusion, the energy sector is undergoing a transformation that presents both challenges and opportunities for investors. By staying informed on market trends, technological advancements, and global developments, traders can position themselves to capitalize on the potential long-term turnaround in relative strength within the energy industry.