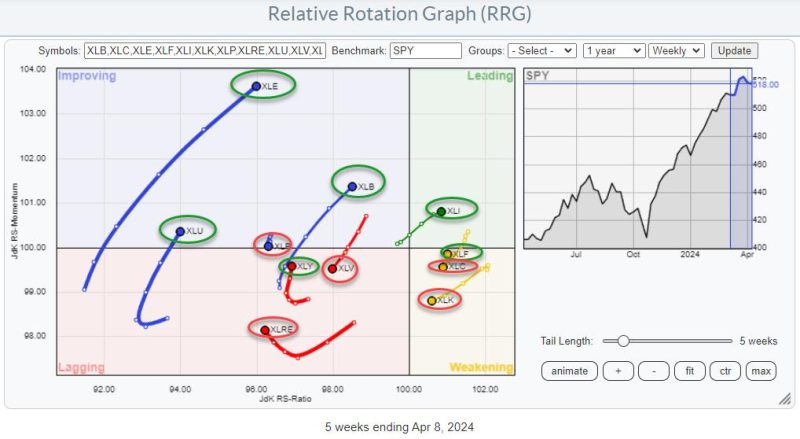

Rapid Recovery Group Indicates Non-Mega Cap Technology Stocks Are Improving

Analyzing the latest updates from the Rapid Recovery Group (RRG) reveals promising trends in non-mega cap technology stocks. As technology continues to reshape industries and drive innovation, it is crucial to monitor the performance of key players beyond the well-established mega-cap companies.

The RRG’s assessment provides valuable insights into the trajectory of non-mega cap technology stocks, shedding light on their potential for growth and resilience in the current market landscape. By diversifying investment strategies to include non-mega cap tech stocks, investors can tap into emerging opportunities and enhance portfolio performance.

One key takeaway from the RRG’s analysis is the improved outlook for non-mega cap technology stocks. While mega-cap tech companies have long dominated the market, smaller and mid-sized tech firms are showing signs of strength and adaptability. This shift underscores the dynamic nature of the technology sector and the opportunities presented by lesser-known players.

Moreover, the RRG’s findings suggest that non-mega cap technology stocks are gaining traction among investors seeking to capitalize on niche markets and emerging technologies. By focusing on these hidden gems within the tech sector, investors can potentially unlock untapped value and drive returns in a competitive market environment.

Additionally, the RRG’s assessment highlights the importance of thorough research and due diligence when exploring investment opportunities in non-mega cap technology stocks. While these companies may offer compelling growth prospects, it is essential to understand their business models, competitive advantages, and market positioning to make informed investment decisions.

Furthermore, the RRG’s insights underscore the need for a balanced investment approach that combines exposure to both mega-cap and non-mega cap technology stocks. By diversifying across different segments of the tech sector, investors can mitigate risk and capitalize on a broad spectrum of growth opportunities.

In conclusion, the Rapid Recovery Group’s analysis points to a positive outlook for non-mega cap technology stocks, hinting at their potential to outperform in the current market environment. By keeping a pulse on these emerging players and incorporating them into investment strategies, investors can establish a well-rounded portfolio that is positioned for long-term success in the ever-evolving tech landscape.