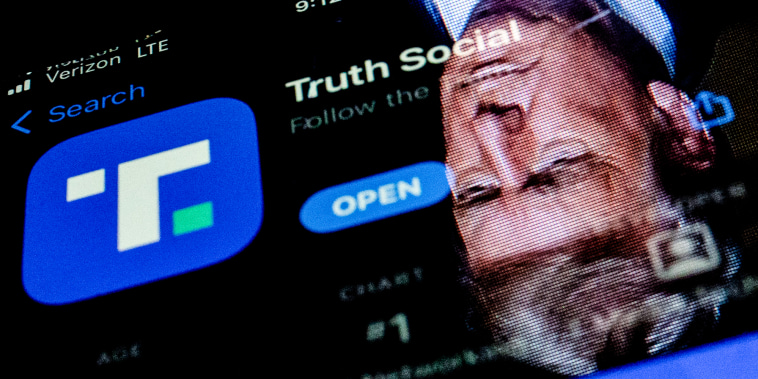

In a surprising turn of events, President Trump’s media empire faced a significant setback as the company filed to issue additional DJT stock, causing a sharp decline in media shares. This move comes amidst a backdrop of changing dynamics in the media industry and raises questions about the future of the company.

The decision to issue additional DJT stock was met with mixed reactions from investors and industry analysts. Some view it as a strategic move to raise capital and potentially fund new ventures or acquisitions. Others, however, see it as a sign of financial distress or a lack of confidence in the company’s ability to generate returns.

The impact of this development on media shares was immediate and substantial, with prices plummeting soon after the news broke. Shareholders, already wary of the company’s performance in the competitive media landscape, were quick to respond to the uncertainty surrounding the stock issuance.

This decline in media shares reflects broader concerns about the challenges facing traditional media companies in the digital age. The rise of streaming services, social media platforms, and changing consumer behaviors have disrupted the industry and forced companies to adapt quickly or risk falling behind.

For President Trump’s media empire, the decision to issue additional DJT stock represents a pivotal moment in its evolution. The company must now navigate the consequences of this move while also charting a course for future growth and sustainability in an increasingly crowded and competitive media landscape.

As the industry continues to evolve, companies like President Trump’s media empire will need to stay agile, innovative, and responsive to changing market conditions. The fallout from the stock issuance serves as a sobering reminder of the challenges and opportunities that lie ahead for traditional media companies in the digital era.