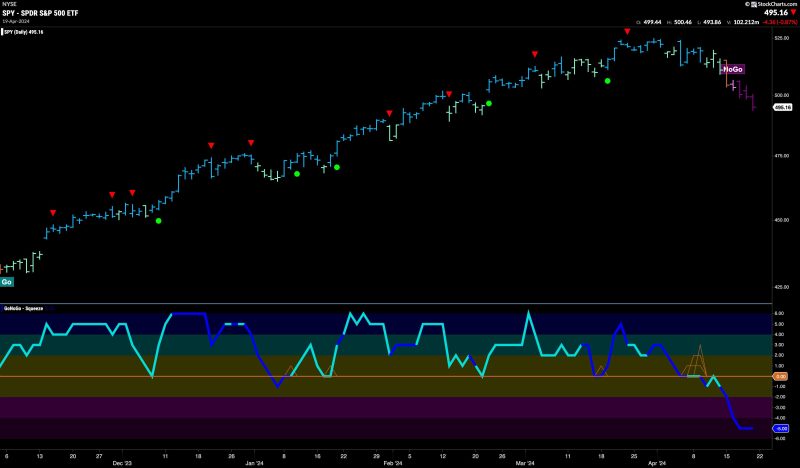

Equities Struggle in Strong No-Go as Materials Try to Curb the Damage

The global financial landscape has witnessed a swirling tide of volatility as equities struggle to maintain their foothold amidst a turbulent economic environment. The recent market movements have left investors and analysts alike scrambling to make sense of the shifting dynamics and unpredictable nature of the current market conditions. In the midst of this uncertainty, one sector that has shown resilience in trying to curb the damage is the materials industry.

The materials sector, encompassing a diverse range of industries such as mining, chemicals, and construction materials, has been navigating its way through the storm by implementing strategic measures to mitigate the impact of the market volatility. Despite the challenging environment, materials companies have been adapting swiftly to the changing landscape, leveraging their resilience and flexibility to weather the storm.

One of the key factors driving the performance of the materials sector is the ongoing supply chain disruptions caused by the global pandemic. The disruptions in the supply chain have led to fluctuations in raw material prices, creating significant challenges for materials companies in managing their costs and operations efficiently. In response to these challenges, materials companies have been focusing on enhancing their supply chain resilience, re-evaluating their sourcing strategies, and optimizing their inventory management practices to mitigate the impact of the disruptions.

Furthermore, the materials sector has also been proactively engaging in sustainable practices and initiatives to strengthen their market position and build long-term resilience. Companies in the materials industry have been increasingly investing in sustainable technologies, adopting eco-friendly practices, and enhancing their environmental stewardship to address the growing demand for sustainable products and solutions. By aligning their business strategies with sustainability goals, materials companies are not only mitigating risks associated with climate change and environmental regulations but are also positioning themselves for long-term growth and competitiveness.

Another critical factor contributing to the resilience of the materials sector is the increased focus on innovation and digital transformation. Materials companies are investing in advanced technologies such as artificial intelligence, data analytics, and automation to streamline their operations, improve efficiency, and drive innovation across their value chain. By embracing digital transformation, materials companies are enhancing their competitiveness, accelerating their time-to-market, and strengthening their market position in the face of evolving market dynamics.

In conclusion, while equities continue to struggle amidst the strong No-Go market sentiments, the materials sector has showcased a commendable level of resilience and adaptability in trying to curb the damage. By implementing strategic measures to navigate through the storm, embracing sustainability practices, and leveraging innovation and digital transformation, materials companies are positioning themselves for long-term success and growth. As the global economy continues to evolve, the materials sector stands poised to emerge stronger and more resilient, setting the stage for a dynamic and thriving industry landscape in the years to come.