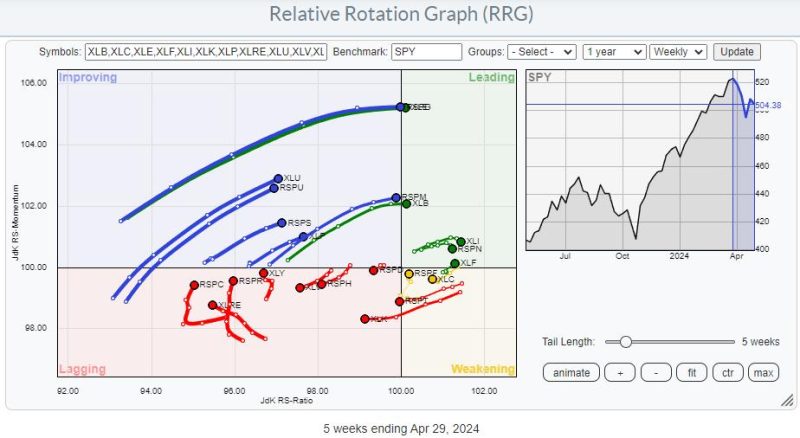

Relative Rotation Graph (RRG) analysis has become a powerful tool in the world of trading and investing. By visualizing the strength and momentum of different securities or asset classes relative to a benchmark, RRGs provide valuable insights for decision-making. One interesting aspect of RRG analysis is the concept of diverging tails, which can unveil unique trading opportunities for astute investors.

Diverging tails on an RRG occur when two assets exhibit opposite movements in terms of both momentum and direction. In other words, while one asset is moving strongly in one direction, the other is moving strongly in the opposite direction. This creates a clear visual separation of the tails on the RRG, indicating a significant divergence in performance.

Identifying diverging tails on an RRG can signal potential trading opportunities for investors. When two assets are moving in opposite directions with strong momentum, it suggests a shift in relative strength between the two assets. This could be a precursor to a potential trend reversal or a significant change in market dynamics.

For example, if Asset A shows a strong upward momentum with its tail pointing northeast on the RRG, while Asset B shows a strong downward momentum with its tail pointing southwest, this indicates a clear divergence between the two assets. Investors can interpret this as a signal that Asset A is outperforming Asset B significantly, potentially presenting a long opportunity in Asset A or a short opportunity in Asset B.

Furthermore, diverging tails can also help investors identify pairs trading opportunities. By recognizing assets that are moving in opposite directions but are positively correlated, investors can establish a pairs trade that profits from the relative performance between the two assets converging back to their historical relationship.

In conclusion, diverging tails on a Relative Rotation Graph provide a unique visual representation of the relative performance of different assets or securities. By identifying strong momentum in opposite directions, investors can uncover potential trading opportunities, including trend reversals, relative strength shifts, and pairs trading strategies. Incorporating RRG analysis with a focus on diverging tails can enhance decision-making and help investors navigate dynamic market conditions effectively.