In the financial markets, technical analysis plays a crucial role in identifying potential trading opportunities. One of the popular technical indicators used by analysts and traders is the Silver Cross Buy Signal. This signal is triggered when a short-term moving average crosses above a longer-term moving average, indicating a potential bullish momentum in the market.

Recently, the Silver Cross Buy Signal has been observed on major indices such as the Dow Jones Industrial Average (DIA) and the Russell 2000 (IWM), signaling a potential bullish trend in these markets.

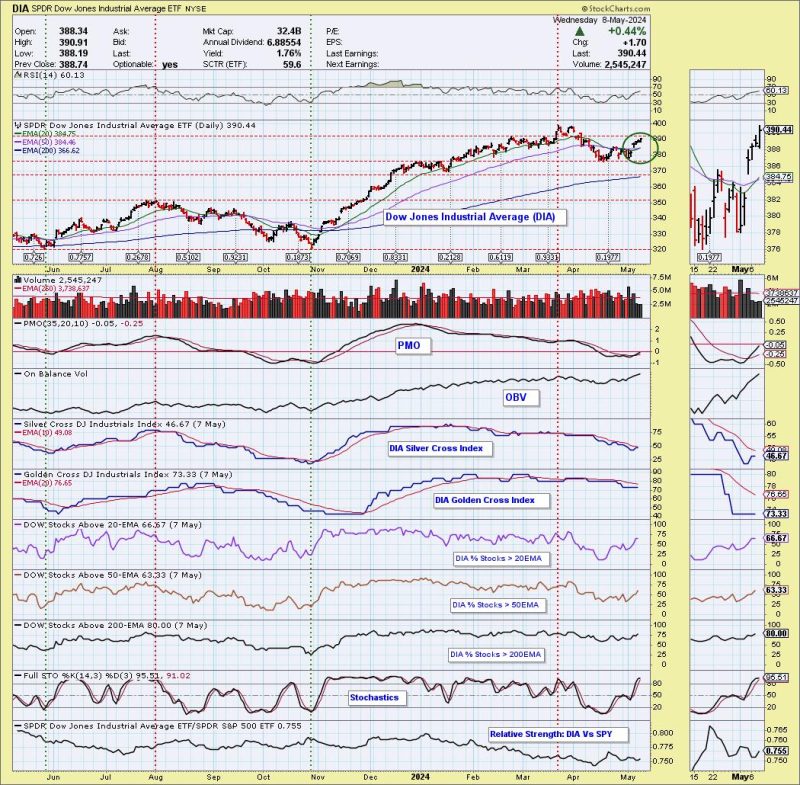

The Dow Jones Industrial Average (DIA), which represents 30 large and well-known public companies in the U.S., has experienced a Silver Cross Buy Signal as the short-term moving average has crossed above the long-term moving average. This signal suggests a potential uptrend in the market, indicating a buying opportunity for traders looking to capitalize on the bullish momentum.

Similarly, the Russell 2000 (IWM), which tracks the performance of small-cap stocks in the U.S., has also displayed a Silver Cross Buy Signal. This signal is significant as small-cap stocks are often considered as leading indicators of the broader market sentiment. The signal on the Russell 2000 indicates a positive outlook for small-cap stocks and the overall market.

Traders and investors use the Silver Cross Buy Signal to make informed decisions on when to enter or exit the market. When this signal is triggered, it can provide a strong indication of the market’s direction in the short to medium term.

It is essential to note that while the Silver Cross Buy Signal is a valuable tool for traders, it should be used in conjunction with other technical and fundamental analysis to make well-rounded trading decisions. Market conditions can change rapidly, and it is important to consider various factors before executing a trade based solely on one indicator.

In conclusion, the recent Silver Cross Buy Signals on the Dow Jones Industrial Average (DIA) and the Russell 2000 (IWM) highlight potential buying opportunities in the market. Traders and investors should closely monitor these signals and use them as part of a comprehensive trading strategy to navigate the dynamic and ever-changing financial markets. By combining technical analysis with other tools, traders can make more informed decisions and improve their chances of success in the market.