In the world of finance and portfolio management, employing rules-based money management strategies is crucial to achieving long-term success and mitigating risks. One essential aspect of this approach is the utilization of security ranking measures to identify and evaluate potential investment opportunities. By objectively assessing the strengths and weaknesses of various securities, investors can make informed decisions that are aligned with their risk tolerance and investment objectives.

One of the key security ranking measures commonly used by investors is fundamental analysis. This method involves analyzing a company’s financial statements, market position, competitive landscape, and industry trends to determine the intrinsic value of a security. By examining metrics such as earnings per share, revenue growth, debt levels, and price-to-earnings ratios, investors can gain valuable insights into the health and performance of a company. Fundamental analysis provides a solid foundation for evaluating the long-term prospects of a security and identifying opportunities for potential growth.

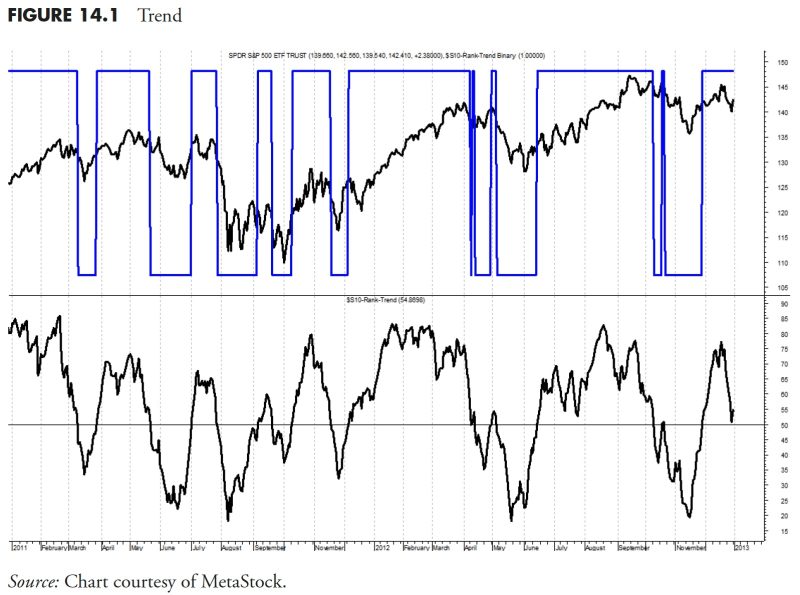

Technical analysis is another important security ranking measure that focuses on analyzing historical price trends and patterns to predict future price movements. By studying charts, indicators, and volume patterns, technical analysts aim to identify key support and resistance levels, trends, and potential entry and exit points for trades. This approach is particularly valuable for short-term traders looking to capitalize on market fluctuations and momentum. By combining technical analysis with other security ranking measures, investors can make more informed decisions and improve the overall performance of their portfolios.

Risk management is a critical component of security ranking measures that helps investors protect their capital and minimize potential losses. By assessing factors such as volatility, correlation, and beta, investors can gauge the level of risk associated with a particular security or portfolio. Diversification is another key aspect of risk management that involves spreading investments across different asset classes, sectors, and geographies to reduce exposure to any single risk factor. Through prudent risk management practices, investors can effectively balance risk and return and optimize the performance of their portfolios over time.

Environmental, Social, and Governance (ESG) criteria have also emerged as important security ranking measures in recent years, reflecting the growing emphasis on responsible and sustainable investing. ESG factors encompass a range of issues, including environmental impact, social responsibility, corporate governance, and ethical business practices. By integrating ESG considerations into their investment decisions, investors can align their portfolios with their values and contribute to positive social and environmental outcomes. Companies that prioritize ESG principles are generally perceived as more resilient, transparent, and well-managed, making them attractive investment opportunities for ethically-minded investors.

In conclusion, security ranking measures play a crucial role in guiding investment decisions and managing risks effectively. By leveraging fundamental analysis, technical analysis, risk management practices, and ESG criteria, investors can enhance the performance and sustainability of their portfolios. Whether seeking long-term growth, short-term gains, or socially responsible investments, utilizing a comprehensive set of security ranking measures can help investors navigate complex markets and achieve their financial goals. By staying disciplined, informed, and adaptable, investors can build resilient portfolios that stand the test of time.