The article posted on godzillanewz.com provides insights into the current state of the market and suggests that it may be reaching a toppy point, implying that a possible downturn or correction could be on the horizon. This analysis is based on various indicators such as valuation metrics, investor sentiment, and historical patterns. While it is crucial for investors to stay informed about market trends and potential risks, it is equally important not to make impulsive decisions based on short-term fluctuations.

Valuation metrics play a significant role in assessing whether the market is overvalued or undervalued. Metrics such as the price-to-earnings (P/E) ratio can give investors an idea of how much they are paying for each dollar of earnings generated by a company. When P/E ratios are high compared to historical averages, it could indicate that stocks are overvalued and due for a correction. However, it is essential to consider other factors such as interest rates, economic growth, and corporate earnings before drawing definitive conclusions.

Investor sentiment is another crucial indicator that can provide insights into market behavior. When investors are overly optimistic and confident, it may signal that the market is vulnerable to a pullback as euphoria peaks. Conversely, extreme pessimism could indicate that stocks are oversold and poised for a rebound. Monitoring sentiment indicators such as the Volatility Index (VIX) or surveys of investor sentiment can help investors gauge market sentiment and potential contrarian opportunities.

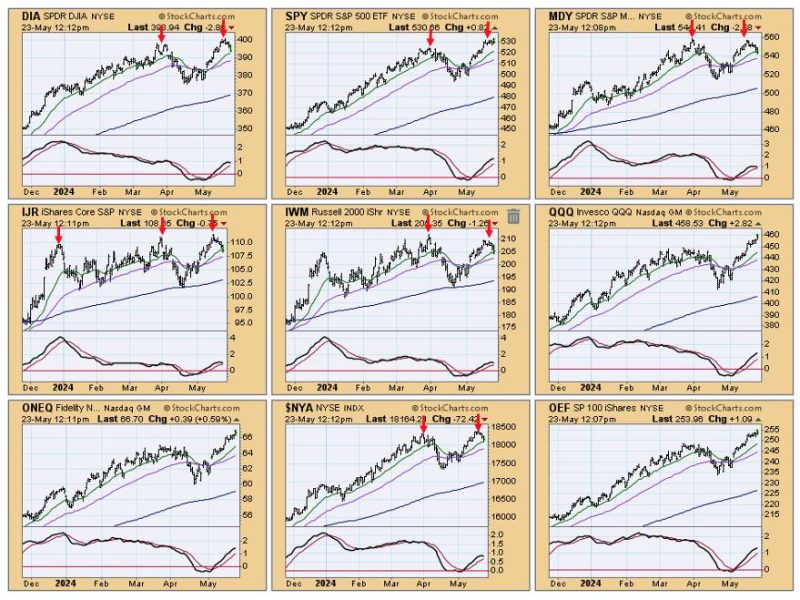

Moreover, historical patterns and market cycles can offer valuable insights into potential market tops. Markets tend to move in cycles of expansion and contraction, and understanding these cycles can help investors anticipate turning points. For example, bull markets are often characterized by periods of euphoria and irrational exuberance, while bear markets are marked by fear and panic selling. Identifying key technical levels and trend reversals can aid in determining whether the market is nearing a potential top or bottom.

In conclusion, while the analysis presented in the article suggests that the market may be approaching a toppy phase, it is essential for investors to approach such assessments with caution and a long-term perspective. Markets are inherently unpredictable, and attempting to time the market based on short-term indicators can be risky. Instead, investors should focus on a diversified portfolio, sound risk management, and a disciplined investment strategy to navigate through market cycles and achieve their long-term financial goals.