The current market scenario has been marked by significant volatility, with the Nifty expected to move within a certain range in the upcoming days. As highlighted in the reference article, it becomes crucial for traders and investors to manage their leveraged exposures effectively to mitigate risks and safeguard their portfolios.

In light of the turbulent market conditions, it is essential for market participants to adopt a cautious and strategic approach while navigating the fluctuations in the Nifty. By curtailing leveraged exposures, investors can reduce their vulnerability to sudden market swings and minimize potential losses. This proactive risk management strategy not only protects the capital but also ensures a more sustainable and stable investment journey.

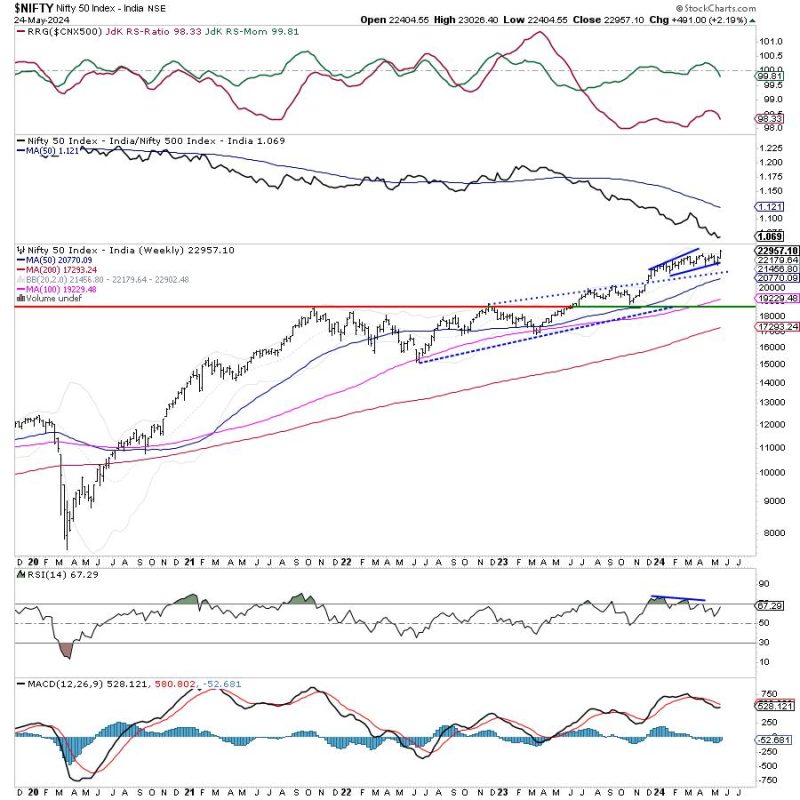

Furthermore, the article emphasizes the importance of monitoring market trends and indicators closely to make informed decisions. By staying abreast of the latest developments and analyzing relevant data, traders can identify potential opportunities and adjust their positions accordingly. A disciplined and research-driven approach is key to navigating the uncertainties in the market and optimizing investment outcomes.

Additionally, diversification is another crucial aspect highlighted in the article. By spreading investments across a range of assets and sectors, investors can minimize concentration risk and enhance portfolio resilience. Diversification is a time-tested strategy that helps to mitigate volatility and protect against adverse market movements, providing a buffer against potential losses.

Overall, in a volatile market environment where the Nifty is expected to move within a specific range, prudence and caution are paramount. By curtailing leveraged exposures, monitoring market trends diligently, and embracing diversification, investors can navigate the market uncertainties more effectively and safeguard their financial well-being. Adopting a proactive risk management approach and maintaining a disciplined investment strategy are key pillars for long-term success in the dynamic world of stock trading.