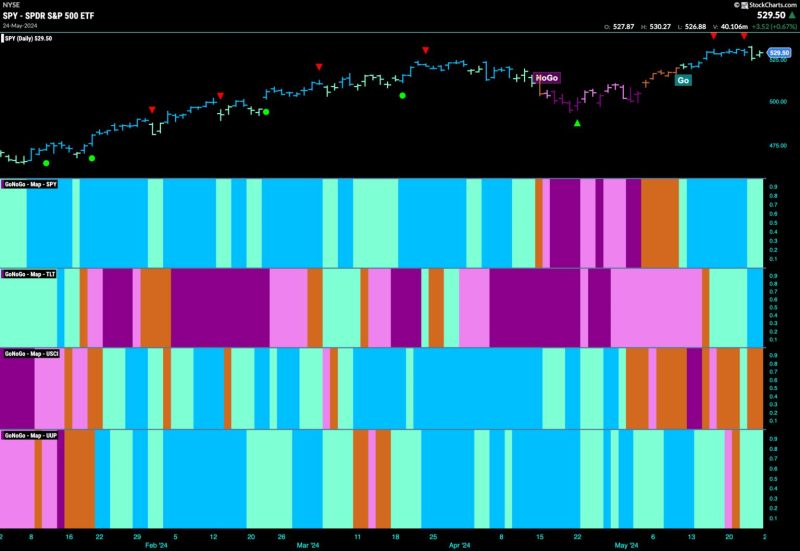

Equities Remain in Go Trend with Sparse Leadership from Tech and Utilities

The stock market has been on a positive trajectory as equities continue to stay in the Go Trend, driven by a combination of factors that have propelled several sectors forward. While tech and utilities have been key players in this growth, there has also been notable leadership from other sectors contributing to the overall market momentum.

One of the significant drivers of the current trend is the ongoing economic recovery following the challenges posed by the COVID-19 pandemic. As businesses reopen and consumer spending rebounds, investors are more optimistic about the future outlook for companies across various sectors. This renewed confidence has translated into increased demand for equities, pushing stock prices higher.

Tech companies have maintained their leadership position in the market, benefiting from the acceleration of digital transformation in the wake of the pandemic. With remote work, online shopping, and digital services becoming more prevalent, tech stocks have attracted investor interest due to their potential for sustained growth. Companies involved in cloud computing, e-commerce, and cybersecurity have particularly thrived during this period.

Utilities, traditionally viewed as defensive stocks, have also played a role in supporting the market’s upward trend. These companies, known for their stable revenues and dividends, have provided a safe haven for investors seeking protection against economic uncertainties. Their reliable income streams have made them an attractive option for those looking for lower-risk investment opportunities.

Beyond tech and utilities, other sectors have demonstrated strong leadership qualities, contributing to the overall positive performance of equities. Industries such as healthcare, consumer staples, and industrials have shown resilience and adaptability in the face of evolving market conditions. Healthcare companies have been at the forefront of developing vaccines and treatments for COVID-19, bolstering investor confidence in the sector.

Consumer staples, essential goods and services that people rely on daily, have also performed well, reflecting their defensive nature during uncertain times. Companies in this sector have benefitted from stable demand for products like food, beverages, and household essentials. Industrials, on the other hand, have benefited from increased infrastructure spending and a rebound in manufacturing activity.

In conclusion, equities continue to remain in a positive trend, buoyed by a diverse range of factors driving market performance. While tech and utilities have been prominent leaders, other sectors have also made significant contributions to the overall momentum. As investors navigate through the uncertainties of the post-pandemic landscape, staying informed about sector dynamics and market trends will be key to making informed investment decisions.