The Hindenburg Omen and Market Instability: Demystifying the Initial Sell Signal

Understanding the intricacies of technical market indicators is crucial for investors seeking to navigate the complexities of the financial landscape. One such indicator that has garnered attention in recent times is the Hindenburg Omen, which has recently flashed an initial sell signal, causing ripples of concern among market participants. In this article, we delve into the concept of the Hindenburg Omen, its significance, and the implications of its recent activation.

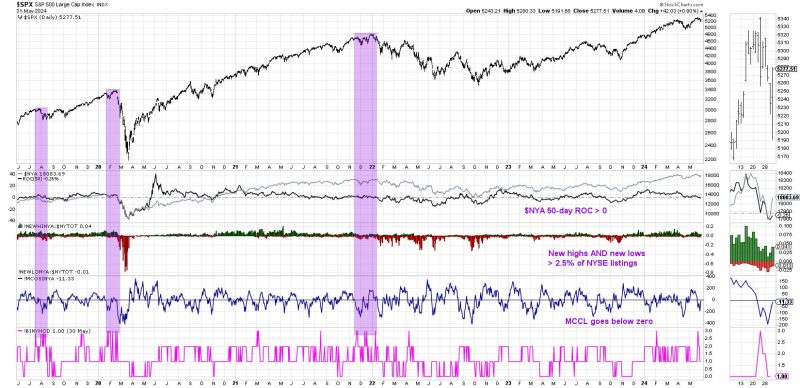

The Hindenburg Omen is a technical indicator named after the infamous Hindenburg disaster of 1937, characterized by a series of market conditions that, when met simultaneously, signal potential market instability. These conditions include a high number of new 52-week highs and lows, as well as a rising 10-week moving average on the NYSE composite index. When these criteria are met, it is considered a warning sign of a potential market downturn.

The recent activation of the Hindenburg Omen’s initial sell signal has raised concerns among investors, as it suggests a heightened likelihood of market turbulence ahead. While the Hindenburg Omen is not a foolproof predictor of market crashes, it serves as a valuable tool for investors to assess the underlying market conditions and adjust their portfolios accordingly.

It is crucial to note that the Hindenburg Omen should be used in conjunction with other technical and fundamental analysis tools to make well-informed investment decisions. Market dynamics are influenced by a multitude of factors, and a singular indicator should not be relied upon as the sole basis for investment strategies.

Investors should remain vigilant in monitoring market developments, staying informed about economic trends, geopolitical events, and corporate performance. Diversification, risk management, and a long-term perspective are essential components of a sound investment strategy, especially in times of heightened market uncertainty.

While the activation of the Hindenburg Omen’s initial sell signal may prompt caution among investors, it is important to approach such indicators with a balanced perspective. Market volatility is a natural part of the investment landscape, and prudent risk management practices are key to weathering fluctuations and achieving long-term financial objectives.

In conclusion, the Hindenburg Omen serves as a valuable technical indicator for investors to gauge market sentiment and potential instability. By understanding its implications and incorporating it into a comprehensive investment strategy, investors can navigate market fluctuations with greater confidence and resilience. Stay informed, stay vigilant, and approach market indicators with a critical yet strategic mindset to make informed investment decisions.