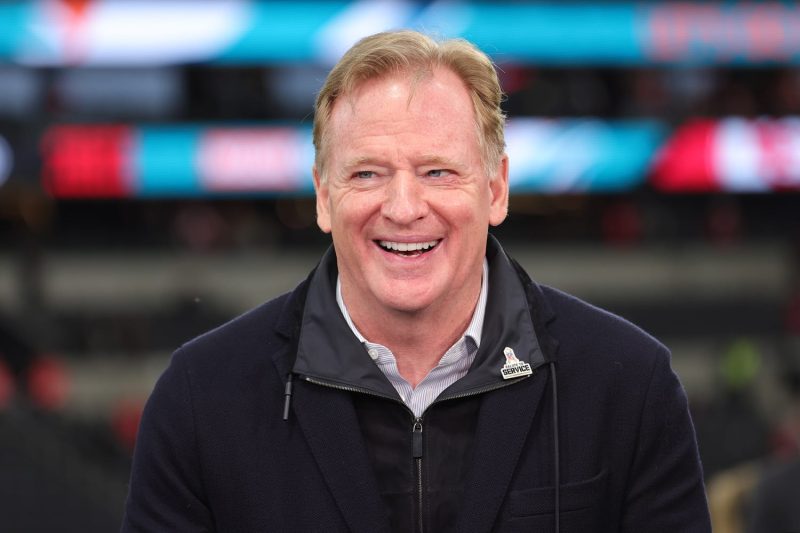

The NFL, like many other major sports leagues, is constantly evolving and adapting to the changing landscape of professional sports ownership. The recent announcement by Commissioner Roger Goodell that the league is open to private equity team ownership of up to 10% marks a significant shift in the traditional ownership structure of NFL teams.

Private equity firms are financial investors that raise capital from high-net-worth individuals and institutional investors to acquire ownership positions in companies with the goal of generating a return on investment. In the context of sports team ownership, private equity firms can bring substantial financial resources and strategic expertise to the table, which can help franchises achieve long-term success on and off the field.

However, the potential entry of private equity firms into NFL ownership raises several important questions and considerations. One of the key concerns is how this new ownership structure could impact the competitive balance of the league. Historically, the NFL has been known for its strong commitment to parity and fair competition, with measures such as the salary cap and revenue sharing designed to level the playing field among teams. The introduction of private equity ownership could potentially introduce new dynamics that may tilt the competitive balance in favor of teams with more financial resources.

Another aspect to consider is the potential influence of private equity owners on team decision-making and league policies. Unlike traditional owners who are often deeply rooted in the local community and have a long-term commitment to the team, private equity owners may have different priorities and a more profit-driven approach to ownership. This could impact key decisions such as player acquisitions, stadium investments, and even league-wide initiatives that shape the future direction of the NFL.

On the positive side, private equity ownership could bring in fresh perspectives, innovative business strategies, and increased financial stability to NFL teams. In an era where sports franchises are becoming increasingly valuable assets, having the backing of well-capitalized investors could help teams invest in state-of-the-art facilities, modernize their operations, and enhance the overall fan experience.

Ultimately, the decision to allow private equity ownership in the NFL up to 10% will require careful consideration and thoughtful deliberation by the league and its existing owners. Balancing the potential benefits of increased financial resources and strategic expertise with the need to preserve the core values of competitive balance and community engagement will be crucial in shaping the future of the NFL ownership landscape.

As the NFL continues to navigate the complexities of modern sports business, it will be fascinating to see how the entry of private equity firms as team owners unfolds and what impact it will have on the league’s long-term growth and success.