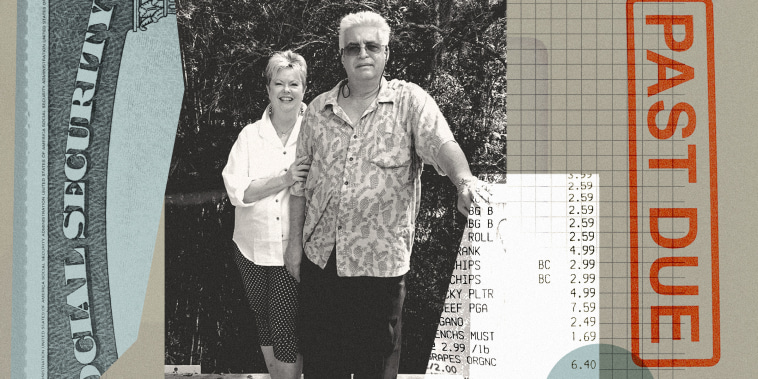

In the article Savings Drained and Living off $2,400 a Month: A Florida Retiree Misses Out on Her Golden Years on GodzillaNewz.com, the story of a Florida retiree struggling to make ends meet sheds light on a pervasive issue faced by many elderly individuals. The retiree, who requested anonymity, has seen her savings dwindle and is now forced to live off a modest monthly income of $2,400. This drastic reduction in financial resources has significantly impacted her ability to enjoy a comfortable retirement, leading her to miss out on the golden years she had envisioned.

One of the key reasons for the retiree’s financial strain is the rising cost of living, particularly in areas like healthcare and housing. With healthcare expenses on the rise and housing costs becoming increasingly unaffordable, the retiree has been forced to make significant cutbacks in her daily expenses. This has resulted in a diminished quality of life, as she struggles to cover basic needs and is unable to afford leisure activities or travel, which are often considered staples of retirement.

Additionally, the retiree’s situation is compounded by the fact that she lacks a robust financial plan and did not adequately prepare for retirement. Without a solid savings cushion or investments to fall back on, she found herself ill-equipped to navigate the financial challenges that often accompany retirement. This highlights the importance of careful financial planning and saving early on to ensure a comfortable retirement in later years.

Furthermore, the retiree’s story underscores the broader issue of financial insecurity among elderly individuals. Many retirees across the country are facing similar struggles, as they grapple with mounting expenses and inadequate savings. This paints a grim picture of retirement for a significant portion of the population, emphasizing the importance of addressing financial literacy and ensuring that individuals are equipped to make informed decisions about their finances.

In conclusion, the story of the Florida retiree serves as a poignant reminder of the challenges faced by many elderly individuals in their retirement years. As the cost of living continues to rise and financial security remains elusive for many, it is essential for individuals to start planning and saving for retirement early on. By taking proactive steps to secure their financial future, individuals can avoid finding themselves in a similar predicament and enjoy a more comfortable and fulfilling retirement.