The Double Top Pattern on Semiconductors (SMH)

Semiconductors have always been a crucial component in the tech industry, powering the devices that we use on a daily basis. Investors often keep a close eye on the performance of semiconductor stocks as they can provide valuable insights into the overall health of the technology sector. One key technical analysis pattern that traders use to predict potential market reversals is the double top pattern.

The double top pattern is a bearish reversal pattern that signals a possible change in the prevailing trend. It is formed when the price of a stock or index reaches a peak, retraces, rallies again to a similar peak level, and then fails to break through that level, reversing course instead. This pattern is often seen as a warning sign that the stock or index may be losing momentum and could be due for a downward correction.

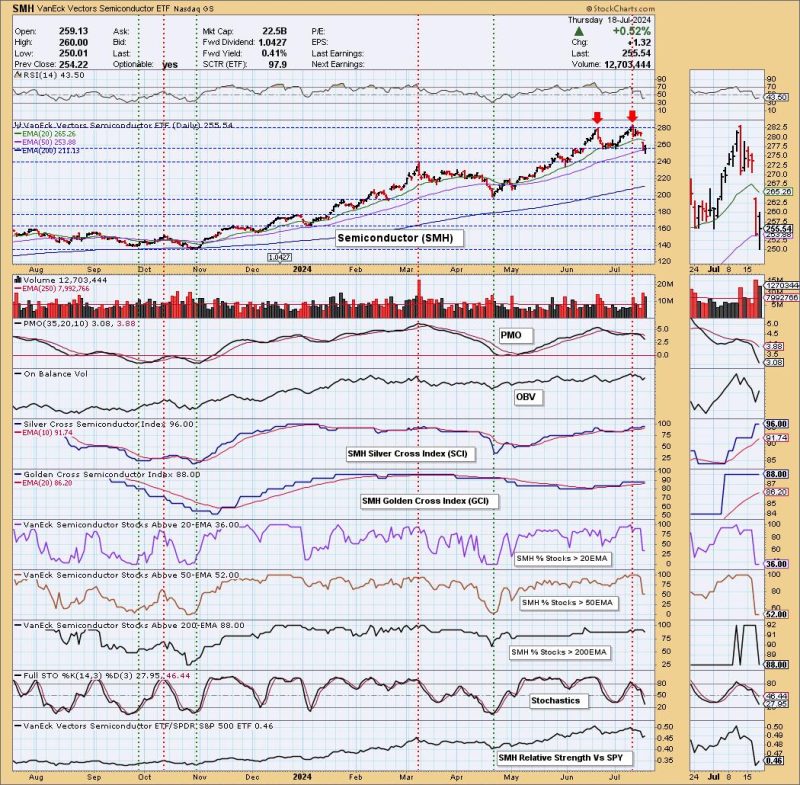

In the case of the semiconductor industry, the VanEck Vectors Semiconductor ETF (SMH) serves as a popular benchmark for tracking the performance of semiconductor stocks. Looking at the chart of SMH, we can observe a potential double top pattern forming. The first peak occurred in early July, followed by a retracement, and then another rally to a similar peak level in early September. However, instead of breaking through to new highs, the price of SMH has struggled to maintain momentum and has started to show signs of weakness.

As traders analyze this double top pattern on SMH, they will be closely monitoring key support levels to determine if the price will indeed reverse its course and begin a downward trend. If the price breaks below the neckline of the double top pattern, which is the support level that connects the lows between the two peaks, it could indicate further downside movement.

It is important to note that technical patterns such as the double top are not foolproof indicators and should be used in conjunction with other forms of analysis to make well-informed trading decisions. Market conditions, economic data, and news events can all influence the price movement of semiconductor stocks and impact the validity of technical patterns.

In conclusion, the double top pattern on semiconductor stocks, as exemplified by SMH, is a valuable tool for traders to identify potential trend reversals and manage their risk accordingly. By staying vigilant and combining technical analysis with other forms of market research, investors can navigate the complexities of the stock market with greater confidence and precision.