Market sentiment plays a crucial role in influencing the direction of financial markets. Three key market sentiment indicators have recently pointed towards a bearish phase, signalling potential turbulence ahead for investors. These indicators provide valuable insight into the prevailing mood and attitudes of traders and investors, helping anticipate market shifts and make informed decisions. In this article, we delve into each of these indicators to understand their significance and implications for the market.

The first market sentiment indicator confirming a bearish phase is the Fear and Greed Index. This widely-followed indicator measures the emotions and sentiment of market participants by analyzing various factors such as stock price breadth, volatility, and junk bond demand. A high reading on the Fear and Greed Index signals extreme greed in the market, indicating an overbought condition and a potential reversal in the making. Conversely, a low reading suggests fear and pessimism among investors, implying potential buying opportunities. In the current scenario, a bearish tilt in the Fear and Greed Index underscores caution and a possible downturn in market sentiment.

Another key market sentiment indicator is the Put/Call Ratio, which gauges the ratio of put options to call options traded on a given security. A high Put/Call Ratio indicates an elevated level of bearish sentiment among investors, as they are purchasing more put options to hedge against potential downside risks. Conversely, a low ratio suggests an optimistic outlook, as more investors are buying call options in anticipation of price appreciation. A rising Put/Call Ratio can serve as a contrarian indicator, signaling an oversold market ripe for a rebound. In the current context, an elevated Put/Call Ratio aligns with a bearish sentiment prevailing in the market.

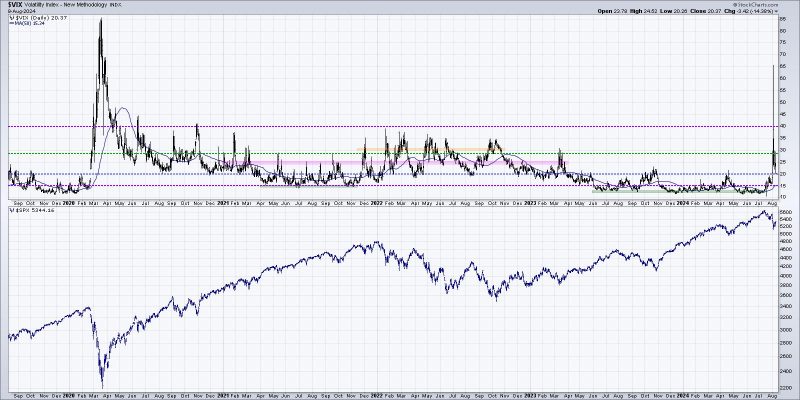

The third important market sentiment indicator confirming the bearish phase is the VIX Index, also known as the fear gauge. The VIX Index measures market volatility and investor fear by tracking the implied volatility of S&P 500 index options. A high VIX reading reflects increased uncertainty and fear among investors, often accompanying market downturns or corrections. On the other hand, a low VIX reading suggests low market volatility and complacency, potentially signaling an impending market rally. In the current environment, a rising VIX Index underscores growing apprehensions and bearish sentiment in the market.

In conclusion, market sentiment indicators are valuable tools for understanding the prevailing mood and attitudes of investors, providing insight into potential market movements. The convergence of multiple indicators confirming a bearish phase highlights the significance of monitoring sentiment to navigate turbulent market conditions effectively. By staying informed and attuned to these indicators, investors can better position themselves to weather market fluctuations and make informed investment decisions.