The global economic landscape is ever-evolving, and the stock market, being a reflection of investors’ sentiments, often oscillates between optimism and caution. This week, the Nifty index has shown a tentative stance as a defensive setup develops, prompting investors to be mindful of key levels for strategic decisions.

The market dynamics have been influenced by various factors, including geopolitical tensions, economic data releases, and corporate earnings reports. With the ongoing uncertainty clouding the markets, investors are treading cautiously, looking for signals to guide their investment strategies.

At this juncture, it is crucial for market participants to have a clear understanding of the key levels that can serve as crucial support and resistance zones. By being aware of these levels, investors can make informed decisions regarding their trading positions and risk management.

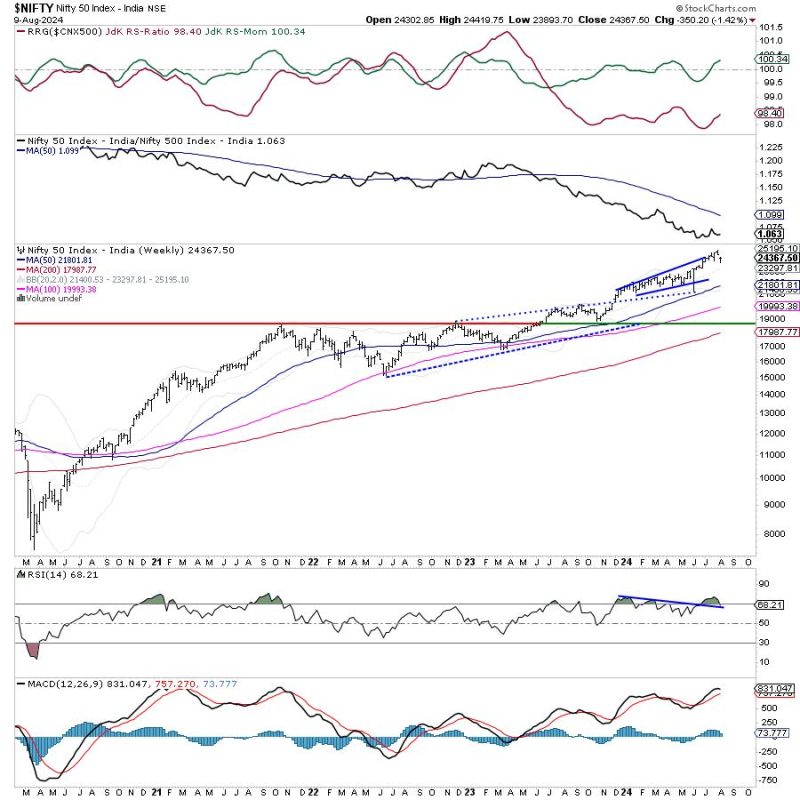

Technical analysis plays a vital role in assessing market trends and price movements. Traders and investors closely monitor chart patterns, moving averages, and key levels to gauge market sentiment and potential price actions.

On the Nifty index, the formation of a defensive setup suggests a shift towards sectors that are considered less susceptible to economic downturns. This defensive posture indicates a cautious approach by investors, focusing on stable and resilient stocks, such as those in the healthcare, consumer staples, and utility sectors.

Amidst the evolving market conditions, keeping a close eye on key levels such as support and resistance can help investors navigate the choppy waters of the stock market. These levels act as crucial inflection points, indicating potential reversals or continuations in price movements.

Investors should also pay attention to macroeconomic indicators, central bank policies, and geopolitical developments that can impact market sentiment. By staying informed and adapting to changing market conditions, investors can position themselves strategically to capitalize on opportunities while managing risks effectively.

In conclusion, the Nifty index’s tentative stance and the development of a defensive setup underscore the importance of being vigilant and strategic in navigating the stock market. By understanding key levels, monitoring technical indicators, and staying informed about market dynamics, investors can make well-informed decisions to enhance their investment outcomes in the midst of uncertainties and challenges.