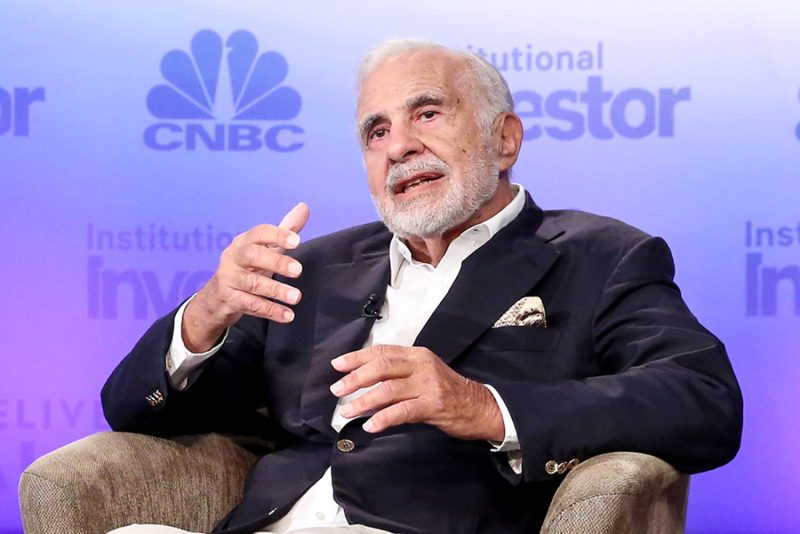

The Securities and Exchange Commission (SEC) has recently charged billionaire investor Carl Icahn with allegations of concealing significant stock pledges worth billions of dollars. This development has sent shockwaves through the financial world and raised questions regarding the transparency and accountability of high-profile investors. The SEC’s investigation into Icahn’s actions sheds light on the complexities of securities laws and the necessity of adhering to stringent regulations to protect investors and maintain market integrity.

According to the SEC, Icahn failed to disclose crucial information about his stock pledges while exerting substantial influence over companies in which he held substantial stakes. By lending his shares as collateral for personal loans without proper disclosure, Icahn allegedly breached reporting obligations established by securities laws. These actions have raised concerns about the potential conflicts of interest that arise when influential investors like Icahn engage in such practices without full transparency.

Furthermore, the SEC’s charges against Icahn highlight the broader issue of regulatory compliance and the need for greater oversight in the financial industry. The case serves as a reminder that even prominent and experienced investors must adhere to the rules and regulations set forth by governing bodies to ensure fair and transparent markets. Failure to do so can undermine investor confidence and erode the integrity of the financial system as a whole.

Additionally, the legal ramifications of the SEC’s charges against Icahn underscore the potential consequences of non-compliance with securities laws. If found guilty, Icahn could face significant penalties and sanctions, including monetary fines and restrictions on his ability to engage in certain financial activities. This case serves as a cautionary tale for investors and financial professionals alike, emphasizing the importance of vigilant compliance with regulatory requirements to avoid legal repercussions.

In conclusion, the SEC’s charges against Carl Icahn represent a significant development in the world of finance, shedding light on the challenges and complexities of regulatory compliance in the securities industry. The case serves as a stark reminder of the importance of transparency, accountability, and adherence to securities laws to uphold market integrity and protect investors’ interests. As the investigation progresses, the outcome of this case will likely have far-reaching implications for investor behavior and regulatory oversight in the financial sector.