In a bizarre turn of events that shocked the state of Kansas, a cryptocurrency pig-butchering scam has left a local bank in ruins and its former CEO facing a hefty prison sentence of 24 years. The intricate details of this elaborate scheme, the subsequent fallout, and the implications it carries for the financial security of small banks in rural America serve as a cautionary tale for both the banking industry and the broader cryptocurrency market.

The confluence of two seemingly unrelated industries, cryptocurrency and pig farming, underscores the level of sophistication and audacity behind this scam. The perpetrators exploited the anonymity and decentralization of cryptocurrency transactions to fund an illicit operation involving the butchering of pigs for profit. By manipulating digital payment channels, they were able to disguise their activities and evade detection for an extended period.

The consequences of this nefarious scheme proved disastrous for the unsuspecting bank caught in the crossfire. As the illicit activities came to light, depositors rushed to withdraw their funds, leading to a run on the bank that ultimately forced its closure. The financial repercussions reverberated throughout the local community, leaving many individuals and businesses reeling from the sudden loss of access to their accounts and investments.

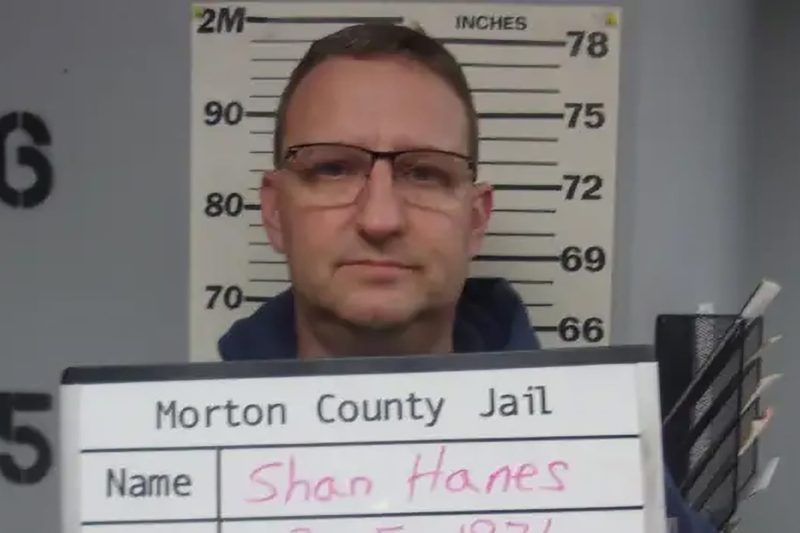

In the aftermath of the scandal, law enforcement agencies launched a thorough investigation to bring the perpetrators to justice. The former CEO of the bank, once a respected figure in the community, was found complicit in the scheme and sentenced to a lengthy prison term. His fall from grace serves as a stark reminder of the risks associated with unchecked greed and a lack of due diligence in the financial sector.

The impact of this scandal extends beyond the immediate participants, raising questions about the efficacy of current regulatory frameworks in the cryptocurrency space. As the popularity of digital assets continues to grow, regulators face mounting challenges in monitoring and policing illicit activities conducted through these channels. The need for enhanced oversight and collaboration between government agencies and financial institutions is more pressing than ever to prevent similar incidents from occurring in the future.

In conclusion, the cryptocurrency pig-butchering scam that decimated a Kansas bank and led to the imprisonment of its former CEO serves as a cautionary tale for the financial industry at large. The convergence of traditional banking with emerging technologies poses new risks and challenges that demand a proactive and vigilant response. By learning from the mistakes and oversights that facilitated this scandal, stakeholders can work together to build a more secure and resilient financial system for the future.