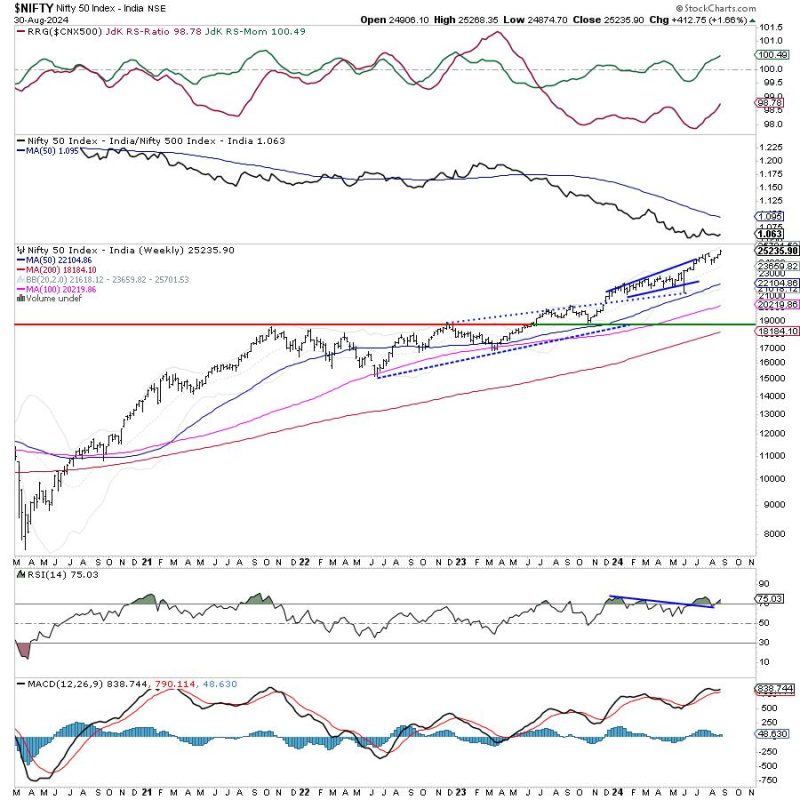

The recent weeks have seen the Nifty index maintaining its uptrend despite fluctuations in the global market. The Relative Rotation Graph (RRG) is depicting a defensive setup for Nifty, indicating the need for cautious optimism among investors.

Analyzing the market trends, we can observe that the Nifty index has managed to hold onto its gains, signifying resilience amidst the current economic uncertainties. The RRG tool provides a unique perspective on the market scenario by plotting the relative strength and momentum of various sectors against the benchmark index.

In the current setup, the RRG chart displays a distinctly defensive positioning for the Nifty index. Sectors such as IT, Pharma, and FMCG are exhibiting relative strength and momentum, suggesting that investors are flocking towards defensive sectors amidst market volatility. On the other hand, sectors like Metals, Energy, and PSU Banks are showing signs of weakness, reflecting the cautious sentiment prevailing in these segments.

It is essential for investors to pay heed to such nuanced market signals provided by tools like RRG to make informed decisions. While the overall uptrend in the Nifty index remains intact, the defensive tilt in the RRG chart indicates a certain level of risk aversion among market participants. This implies that investors should adopt a selective approach while navigating through the current market environment.

The Nifty index’s ability to sustain its uptrend amid a defensive market setup underscores the importance of staying vigilant and adaptable in the face of changing market dynamics. By keeping a close eye on the RRG chart and other relevant indicators, investors can steer their investment strategies in a prudent manner to navigate through the current uncertainties and capitalize on emerging opportunities.

In conclusion, the Nifty index’s resilience in upholding its uptrend, coupled with the defensive stance depicted by the RRG chart, underscores the need for investors to exercise caution and selectivity in their investment decisions. By leveraging tools like RRG and staying abreast of market trends, investors can position themselves strategically to navigate through the prevailing market conditions and optimize their investment outcomes.