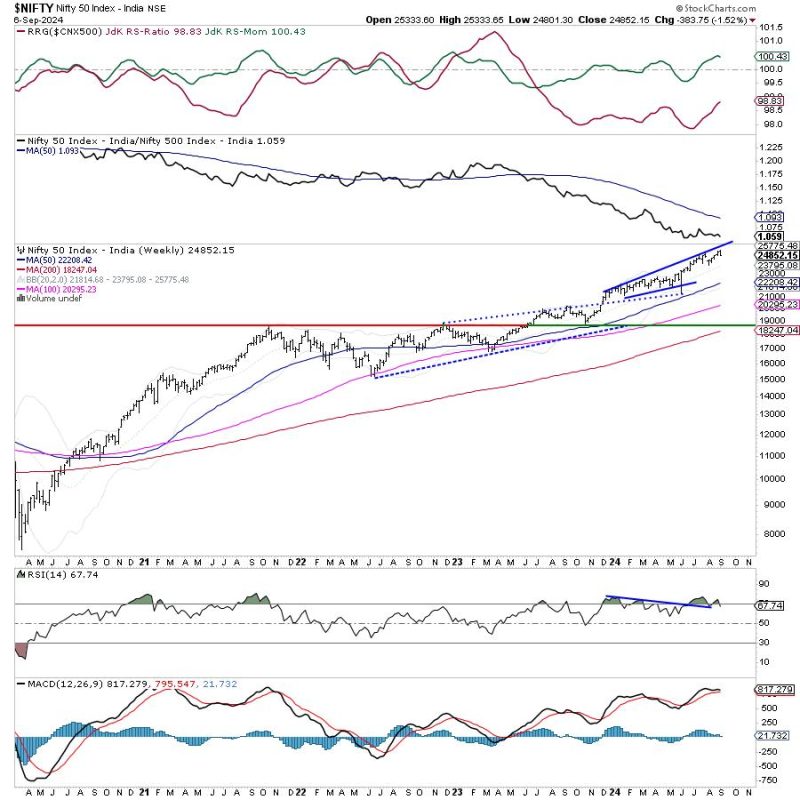

The recent market movement in the Nifty 50 has shown early signs of a potential disruption in the uptrend, prompting investors and traders to exercise caution in the coming days. This shift in trend direction could indicate a significant change in market sentiment and behavior, impacting trading strategies and investment decisions.

Technical analysis of the Nifty 50 index suggests a weakening of the uptrend momentum, with indicators such as moving averages, Relative Strength Index (RSI), and support/resistance levels signaling potential bearish pressure. Traders are advised to closely monitor these technical signals and adjust their positions accordingly to mitigate risks and capitalize on potential opportunities.

Market volatility and uncertainty continue to persist, driven by various internal and external factors such as global economic conditions, geopolitical events, and regulatory changes. These factors can magnify market fluctuations and increase the chances of abrupt trend reversals, making it essential for market participants to stay vigilant and adaptable in their trading approach.

Investors should focus on maintaining a diversified portfolio and adhering to risk management practices to cushion their investments from sudden market shocks. By spreading out their exposure across multiple asset classes and implementing stop-loss orders, investors can minimize potential losses and preserve capital during periods of heightened volatility.

Furthermore, staying informed about market developments, economic data releases, and corporate earnings reports is crucial for making informed investment decisions in a rapidly changing market environment. By conducting thorough research and analysis, investors can identify emerging trends and opportunities that align with their financial goals and risk tolerance.

In conclusion, the Nifty 50 index is displaying early indications of a possible disruption in its uptrend, emphasizing the importance of caution and strategic decision-making for market participants. By leveraging technical analysis tools, managing risks effectively, and staying informed about market dynamics, investors can navigate volatility and uncertainty with confidence and resilience. Adaptability and vigilance are key in navigating turbulent market conditions and achieving long-term investment success.