Equities Say Go Fish: How Healthy Are the Markets?

Equities, or stocks, serve as a vital indicator of the overall health and performance of the financial markets. Investors and analysts closely monitor equities to gauge the current state of the economy and make informed decisions about their investment strategies. While equities can be volatile and subject to fluctuations, understanding their dynamics can provide valuable insights into market trends and potential opportunities.

Equities represent ownership stakes in publicly traded companies, allowing investors to participate in the company’s profits and growth. The performance of equities is influenced by various factors, including company earnings, economic trends, market sentiment, and geopolitical events. As a result, equities can be both an exciting opportunity for growth and a risky investment that requires careful consideration.

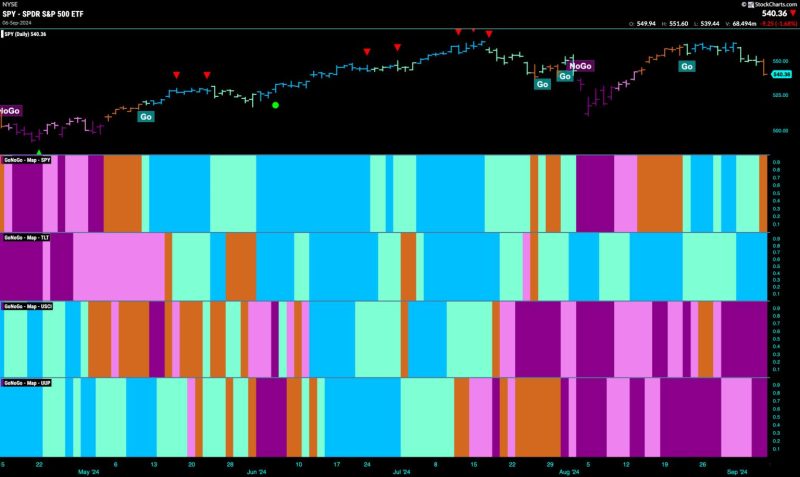

To assess the health of the markets, investors often analyze key equity indices such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. These indices track the performance of a broad range of stocks across different sectors, providing a comprehensive view of the overall market conditions. By monitoring these indices, investors can identify trends, detect potential risks, and make well-informed decisions about their investment portfolio.

Equities can also serve as a barometer of investor confidence and sentiment. During periods of economic uncertainty or market volatility, investors may flock to safer assets such as bonds or gold, leading to a decline in equity prices. Conversely, in times of economic growth and stability, equities tend to perform well as investors seek higher returns on their investments. By analyzing investor behavior and market trends, analysts can gain valuable insights into the underlying dynamics of the markets.

The health of the equities markets is also influenced by macroeconomic factors such as interest rates, inflation, and unemployment. Changes in these variables can impact corporate earnings, consumer spending, and overall economic growth, subsequently affecting equity prices. As central banks adjust monetary policies and governments implement fiscal measures, investors must be vigilant in monitoring these developments and adjusting their investment strategies accordingly.

In conclusion, equities play a crucial role in the financial markets, serving as a key indicator of economic health and investor sentiment. By closely monitoring equity indices, analyzing market trends, and staying informed about macroeconomic factors, investors can navigate the complexities of the markets and make informed decisions about their investment portfolio. While equities can be volatile and unpredictable, they also present opportunities for growth and wealth accumulation for those willing to take calculated risks.