As the week unfolds, market participants are closely monitoring the Nifty index, which appears to be in a consolidation phase. While the Nifty consolidates, it is crucial for investors and traders to keep a keen eye on certain levels that can provide key insights into the market direction.

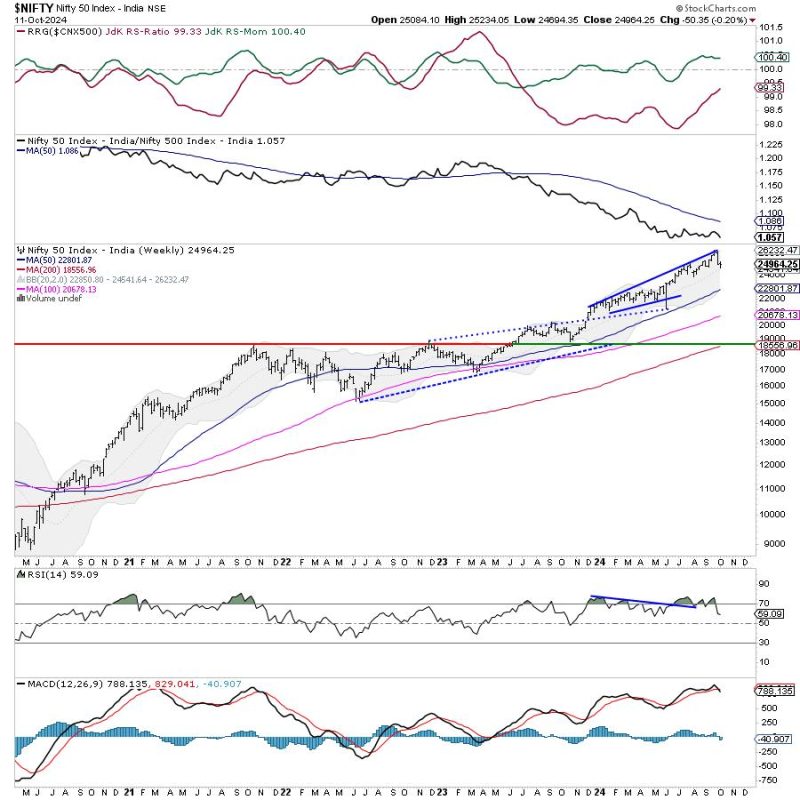

Technical analysis plays a significant role in understanding market trends and identifying potential entry and exit points. In the current scenario, the Nifty index has been hovering around crucial support and resistance levels, indicating a tug of war between buyers and sellers.

For traders looking to capitalize on short-term opportunities, the key level to watch is the immediate support at 16,200. A breach below this level could signal further downside momentum and potentially open the door for a retest of the next support level around 16,000. On the flip side, if the index manages to hold above the support level and starts moving higher, it could pave the way for a potential retest of the resistance level around 16,450.

In addition to the support and resistance levels, traders should also pay attention to key technical indicators like the Relative Strength Index (RSI) and Moving Averages to gauge the market sentiment. A divergence between the price action and these indicators could provide valuable insights into potential trend reversals or continuations.

Moreover, market participants should remain vigilant of any upcoming economic events or corporate announcements that could act as significant catalysts for market movements. Factors like inflation data, GDP numbers, interest rate decisions, and corporate earnings reports can all influence market sentiment and play a crucial role in shaping the market direction.

Risk management is paramount in trading and investors should always adhere to strict stop-loss levels to protect their capital. Emotions often cloud judgment during volatile market conditions, and having a disciplined approach to risk management can help traders navigate uncertain market environments effectively.

In conclusion, while the Nifty index consolidates, traders should focus on key support and resistance levels, technical indicators, and upcoming events to make informed trading decisions. By staying updated with market developments and maintaining a disciplined trading strategy, investors can better position themselves to capitalize on opportunities and manage risks effectively in the dynamic landscape of the stock market.