In recent years, advancements in artificial intelligence (AI) and deep learning technologies have revolutionized various industries and have paved the way for innovative investment opportunities. One such breakthrough is DeepMind’s AlphaFold, a powerful AI system that has shown remarkable capabilities in predicting protein structures. As a result, investors are keen on exploring investment opportunities associated with AlphaFold and its parent company.

Understanding AlphaFold and Its Significance

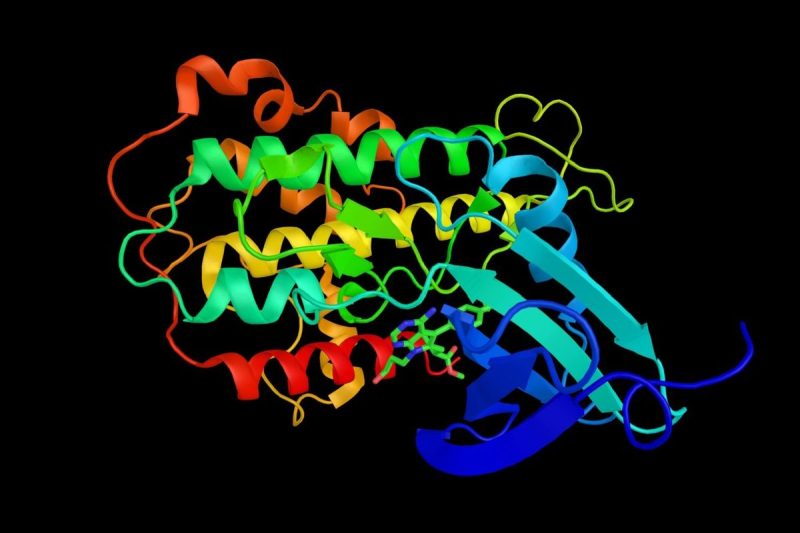

AlphaFold is an AI system developed by DeepMind, a subsidiary of Alphabet Inc., the parent company of tech giant Google. AlphaFold utilizes deep learning algorithms to predict the three-dimensional structures of proteins, which are crucial for understanding various biological processes and developing new treatments for diseases. The accuracy and speed with which AlphaFold can predict protein structures have garnered widespread attention within the scientific community.

Investing in AlphaFold Stock

With the growing interest in AI and biotechnology, investing in AlphaFold stock could potentially present a lucrative opportunity for investors seeking exposure to cutting-edge technologies. However, it is essential to note that AlphaFold itself is not a publicly traded entity. Instead, investors can consider investing in Alphabet Inc., the parent company of DeepMind and AlphaFold.

Alphabet Inc. has a diversified portfolio of businesses, including Google, Waymo, and DeepMind, which positions it as a strong investment option for those looking to capitalize on the potential growth of AlphaFold and other innovative technologies.

Factors to Consider Before Investing

Before making any investment decisions related to AlphaFold or Alphabet Inc. stock, investors should consider several key factors:

1. Company Performance: Evaluate Alphabet Inc.’s financial performance, growth prospects, and competitive positioning within the tech industry.

2. Regulatory Environment: Stay informed about regulatory developments in AI and biotech sectors that could impact the company’s operations.

3. Innovation Pipeline: Assess DeepMind’s ongoing research and development efforts, particularly in advancing AlphaFold technology and its applications.

4. Market Trends: Monitor industry trends and competitive landscape to gauge the growth potential of AI-driven solutions in the biotech sector.

5. Risk Management: Diversify your investment portfolio to manage risks associated with investing in specific companies or sectors.

In conclusion, investing in AlphaFold stock through Alphabet Inc. offers a unique opportunity to capitalize on the convergence of AI and biotechnology. By staying informed about industry trends, evaluating company performance, and managing risks effectively, investors can potentially benefit from the growth potential of AlphaFold and other groundbreaking technologies developed by DeepMind.