In the fast-paced world of the stock market, traders are constantly on the lookout for signals that may indicate whether the market is about to enter a trending phase or remain range-bound. The Nifty index, a key indicator of the Indian stock market, is often closely watched by traders to gauge the market sentiment and potential future movements. As we analyze the upcoming week ahead, it becomes crucial to assess the key levels that could potentially trigger trending moves in the Nifty.

Technical analysis plays a pivotal role in understanding market dynamics and making informed trading decisions. When it comes to the Nifty index, traders often pay attention to specific levels that act as critical support and resistance zones. These levels are not arbitrary but are determined by historical price action and market sentiment.

For the Nifty to break out of its current range and exhibit trending moves, traders will need to closely monitor these key levels:

1. Resistance Levels:

– The upper resistance level for Nifty may be around the 16,000 mark, where a decisive breach could signal a potential uptrend.

– Traders will be closely watching how the index reacts near this level, as a sustained move above it could attract more buyers and drive the index higher.

2. Support Levels:

– On the downside, the Nifty may find support near the 15,650 level, which has acted as a key support in the recent past.

– A breach below this level could indicate weakness in the market and potentially trigger further selling pressure.

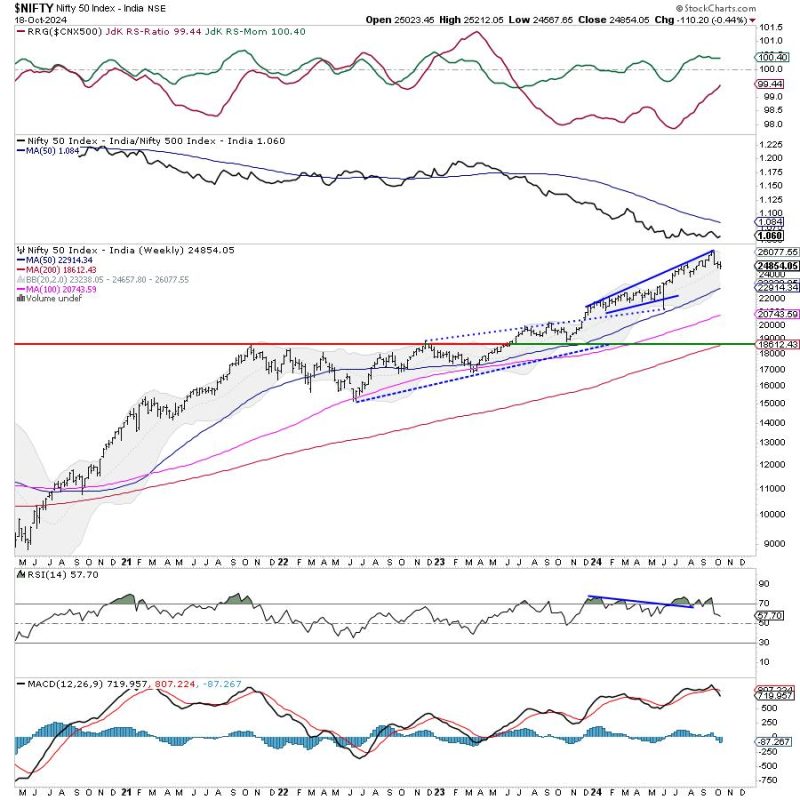

3. Moving Averages:

– Moving averages, such as the 50-day and 200-day moving averages, can also provide valuable insights into the market trend.

– Traders often look for the index to trade above these moving averages to confirm an uptrend or below them for a potential downtrend.

4. Volatility Index:

– Keeping an eye on the volatility index, such as the India VIX, can help traders gauge market uncertainty and potential trend changes.

– A sharp increase in volatility could signal a shift in market sentiment and potentially lead to trending moves in the Nifty.

By incorporating technical analysis and closely monitoring these key levels and indicators, traders can better position themselves to capitalize on potential trending moves in the Nifty index. However, it is essential to remember that market dynamics are unpredictable, and risk management strategies should always be in place to protect capital in volatile market conditions.