The week ahead for the Nifty 50 index appears to be characterized by a sluggish performance, with multiple resistances potentially hindering significant upward movement. As investors and traders navigate the market landscape, it becomes crucial to be aware of the key levels and factors influencing the index’s trajectory.

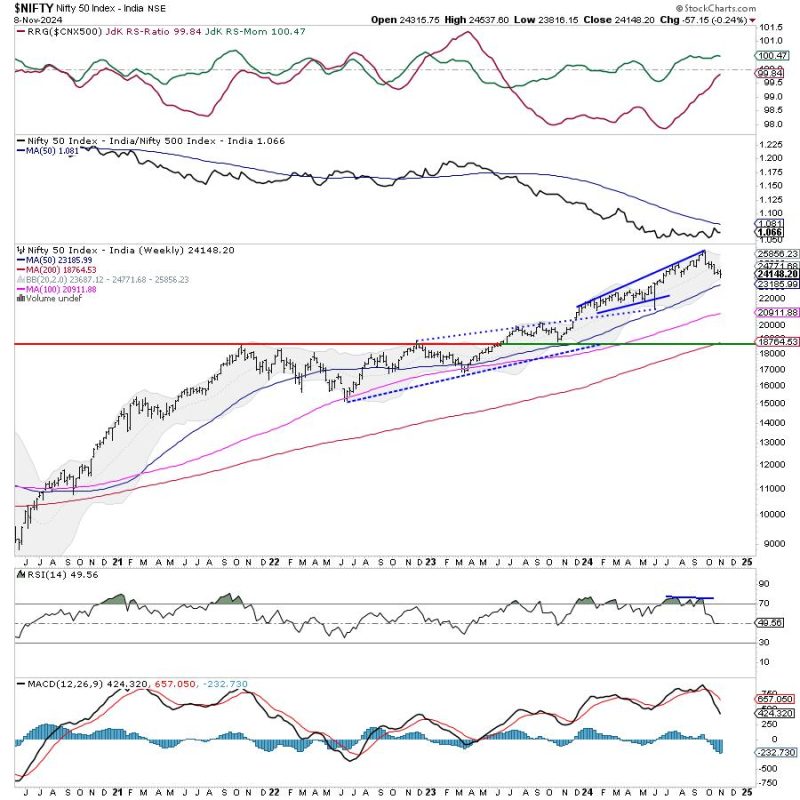

Technical analysis plays a vital role in understanding the potential movements of the Nifty. By analyzing historical price movements and identifying key support and resistance levels, traders can make informed decisions. The presence of multiple resistances in the current zone suggests that the index may struggle to make significant gains in the coming week. This highlights the importance of being cautious and strategizing effectively in such a scenario.

Among the various factors influencing the Nifty’s performance, global market trends and economic indicators hold substantial weight. External factors, such as geopolitical events or global economic data releases, can significantly impact the sentiment of market participants and subsequently influence the direction of the index. Being attuned to these external factors can provide valuable insights into the potential movements of the Nifty.

Investor sentiment also plays a crucial role in shaping market dynamics. A cautious or optimistic sentiment among investors can lead to fluctuations in trading volumes and price movements. It is essential for market participants to gauge the prevailing sentiment and adapt their strategies accordingly to capitalize on potential opportunities or mitigate risks.

Additionally, macroeconomic factors such as interest rates, inflation, and government policies can have a profound impact on the Nifty’s performance. Keeping abreast of economic developments and their implications for the broader market is essential for traders seeking to make informed decisions.

As traders navigate the complex and dynamic market environment, it is imperative to adopt a structured and disciplined approach to trading. Setting clear entry and exit points, managing risk effectively, and adhering to a well-defined trading strategy can help traders navigate the uncertainties of the market and enhance their chances of success.

In conclusion, the upcoming week for the Nifty 50 index is likely to be characterized by sluggish performance, with multiple resistances posing potential hurdles for significant upward movement. By leveraging technical analysis, monitoring key factors influencing the market, and adopting a structured trading approach, market participants can navigate the challenges and opportunities presented by the market landscape.