Investing in Chromium Stocks: A Guide for 2024

Understanding Chromium Market Trends

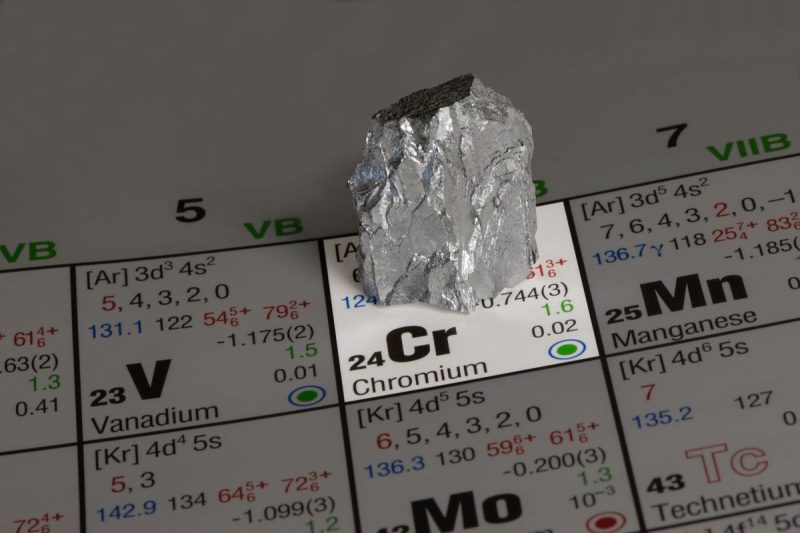

Chromium is a crucial metal that plays a vital role in various industries, including stainless steel production, aerospace, and automotive sectors. As the global economy continues to grow, the demand for chromium is expected to rise, presenting investors with an exciting opportunity to capitalize on this trend.

Key Factors to Consider Before Investing

Before diving into the world of chromium stocks, investors need to consider several key factors to make informed decisions. Firstly, understanding the supply-demand dynamics of the chromium market is essential. Factors such as geopolitical tensions, trade policies, and technological advancements can significantly impact the market.

Secondly, investors should closely monitor global economic indicators and industry trends to gauge the future demand for chromium. A booming economy usually results in higher demand for stainless steel and other chromium-dependent products, driving up the prices of chromium stocks.

Additionally, keeping an eye on regulatory developments and environmental considerations is crucial. As governments around the world push for stricter environmental regulations, chromium producers are compelled to adopt sustainable practices, which can impact their bottom line and stock performance.

Investment Strategies for Chromium Stocks

For investors looking to venture into chromium stocks, several strategies can be employed to optimize returns while managing risks. Diversification is key, as it helps spread risk across multiple companies within the chromium sector. Investing in a mix of large established players and promising smaller companies can provide a balanced portfolio.

Furthermore, conducting thorough research on individual companies is crucial before making any investment decisions. Analyzing financial statements, market positioning, growth prospects, and management quality can help identify companies with strong potential for long-term growth.

Moreover, staying informed about macroeconomic factors that can influence the chromium market is essential. Keeping track of geopolitical developments, trade policies, and industry-specific trends can help investors make informed decisions and mitigate potential risks.

Risk Management and Long-Term Growth

While investing in chromium stocks can offer lucrative returns, it is essential for investors to employ risk management strategies to protect their investments. Setting stop-loss orders, diversifying portfolios, and staying informed about market developments can help mitigate potential risks and preserve capital.

In conclusion, investing in chromium stocks can be a rewarding venture for investors who are willing to conduct thorough research, stay informed about market trends, and manage risks effectively. By understanding the dynamics of the chromium market, employing sound investment strategies, and adhering to risk management principles, investors can position themselves for long-term growth and success in the evolving world of chromium stocks.