Certainly! Here is a structured article based on the provided reference:

—

**The Path Ahead: Will USD Emerge Strong in the Global Currency Market?**

**The Current Scenario:**

The global currency market is a dynamic ecosystem, influenced by a myriad of factors that drive constant fluctuations. Amidst this complex environment, the USD has been a dominant player for decades. Recent trends, however, suggest a potential shift in its position. As we analyze the indicators and market sentiment, speculations are rife about the USD setting up for a robust rally.

**Technical Analysis:**

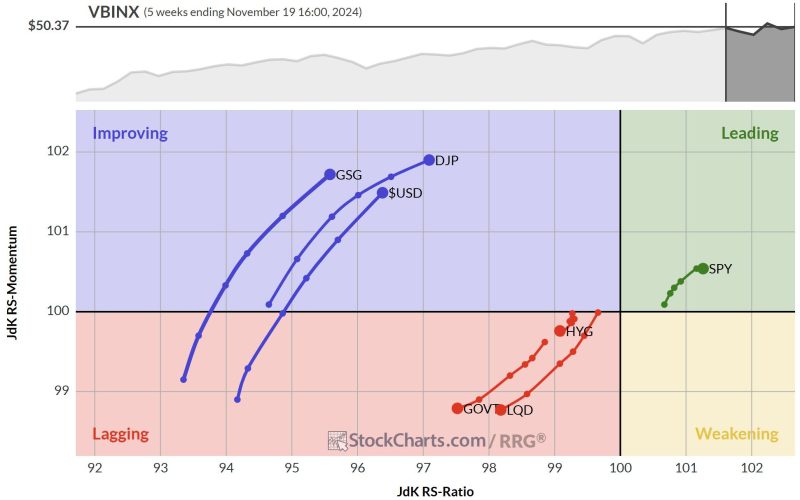

Technical analysis plays a crucial role in predicting currency movements. The USD’s recent performance against key counterparts like the Euro and Yen has been closely scrutinized by analysts. Chart patterns reveal intriguing insights, hinting at a possible bullish trajectory for the USD in the near future.

**Fundamental Factors:**

Beyond technical indicators, fundamental factors hold significant sway over currency movements. The US economy’s resilience in the face of global challenges has bolstered confidence in the USD. Factors such as GDP growth, inflation rates, and monetary policy decisions all play a crucial role in shaping market sentiment towards the greenback.

**Market Sentiment:**

Market sentiment is a powerful force that can drive abrupt shifts in currency values. Traders and investors closely monitor geopolitical developments, trade agreements, and macroeconomic data to gauge the USD’s strength. Positive sentiment towards the USD can create a domino effect, leading to increased demand and a potential rally.

**External Influences:**

External factors, such as geopolitical tensions, trade disputes, and global economic trends, can also impact the USD’s performance. The ongoing pandemic, US-China relations, and Brexit negotiations are just a few examples of external influences that could shape the USD’s trajectory in the coming months.

**Risk Factors:**

While the outlook for the USD appears promising, it is essential to acknowledge potential risk factors that could derail its rally. Sudden shifts in market sentiment, geopolitical events, or unexpected economic data releases could introduce volatility and uncertainty, challenging the USD’s upward momentum.

**Conclusion:**

As we navigate the intricacies of the global currency market, the USD’s potential for a strong rally remains a topic of intense speculation and analysis. By closely monitoring technical indicators, fundamental factors, market sentiment, and external influences, traders and investors can gain valuable insights into the USD’s future trajectory. While risks persist, the USD’s resilience and inherent strengths position it favorably for a possible upward surge in the foreseeable future.

Unveiling the mysteries of currency markets requires a blend of analytical prowess, market knowledge, and foresight. As the USD charts its course in the ever-evolving landscape of global finance, prudent observation and strategic decision-making will be key to navigating the opportunities and challenges that lie ahead.

—

This structured article provides an in-depth analysis of the factors influencing the USD’s potential rally in the global currency market, offering valuable insights for traders and investors.