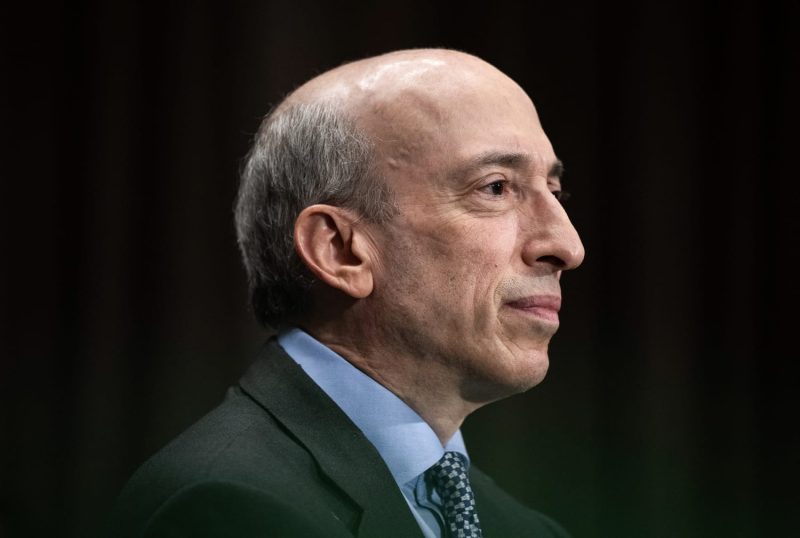

In a surprising turn of events at the highest echelons of the Securities and Exchange Commission (SEC), Chairman Gary Gensler has announced his decision to step down from his position effective January 20. This development paves the way for a replacement to be appointed by the incoming Trump administration.

During his tenure as SEC Chair, Gary Gensler has been credited with spearheading numerous regulatory initiatives aimed at bolstering transparency and accountability in the financial markets. His background as a former Goldman Sachs executive and Commodity Futures Trading Commission chairman provided him with a unique perspective that he utilized to push for stronger oversight of Wall Street.

One of Gensler’s most prominent achievements was overseeing the implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act following the 2008 financial crisis. This comprehensive piece of legislation sought to prevent another collapse of the financial system by imposing stricter regulations on banks and other financial institutions.

Under Gensler’s leadership, the SEC also made significant strides in enhancing cybersecurity measures to protect against increasingly sophisticated threats posed by cybercriminals. By working closely with industry stakeholders and government agencies, Gensler sought to ensure that investors’ personal information and financial data remained secure.

In addition to Gensler’s regulatory efforts, he also sought to promote greater diversity and inclusion within the financial sector. By championing initiatives to increase the representation of women and minorities in leadership positions, Gensler aimed to create a more inclusive and equitable industry that reflected the diverse makeup of society.

As Chairman Gensler prepares to leave his post, speculation is rife about who will be selected to succeed him. With the upcoming transition to a new administration, the choice of Gensler’s replacement will be closely scrutinized for its potential impact on the direction of financial regulation in the United States.

In conclusion, Gary Gensler’s decision to step down as SEC Chair marks the end of a tenure marked by significant regulatory achievements and a steadfast commitment to upholding the integrity of the financial markets. His successor will inherit a challenging landscape that demands a nuanced approach to balancing the needs of investors, industry stakeholders, and the broader economy.