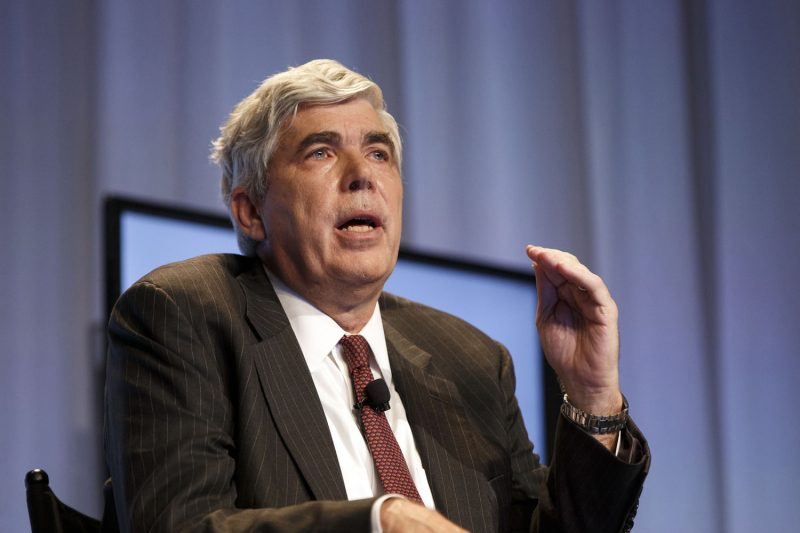

Headline: Former Wamco Executive Kenneth Leech Charged With Fraud by U.S. Authorities

The recent indictment of former Wamco executive Kenneth Leech by U.S. authorities has sent shockwaves through the financial community. The charges, which include allegations of fraud and misconduct, have raised concerns about the integrity and transparency of the investment management industry. The case has also highlighted the importance of regulatory oversight and the need for increased accountability in the financial sector.

According to the charges brought against Leech, he engaged in a series of fraudulent activities that resulted in significant losses for Wamco and its investors. These activities allegedly included misleading investors about the performance of certain investment products, misrepresenting the risks associated with these products, and engaging in unauthorized trading on behalf of clients. The indictment also accuses Leech of using client funds for personal gain and failing to disclose conflicts of interest.

The implications of these charges are far-reaching, as they call into question the trustworthiness of financial professionals and the safeguards in place to protect investors. The case serves as a reminder of the importance of due diligence and vigilance when selecting investment advisors and entrusting them with financial decisions.

In response to the charges, Wamco issued a statement expressing shock and disappointment at the alleged actions of Leech. The company emphasized its commitment to upholding the highest ethical standards and pledged to cooperate fully with the authorities in their investigation. Wamco also reassured its clients that their investments were being handled with the utmost care and attention.

The case against Kenneth Leech serves as a warning to others in the financial industry who may be tempted to engage in fraudulent or unethical behavior. It underscores the need for increased vigilance and oversight to prevent such incidents from occurring in the future. By holding individuals accountable for their actions and strengthening regulatory frameworks, we can help protect investors and uphold the integrity of the financial markets.