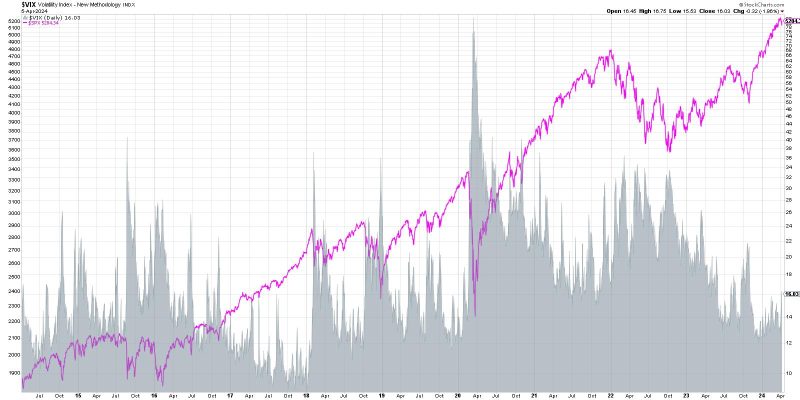

Spikes in the VIX Above 16: What It Means for Investors

As investors navigate the unpredictable waters of the financial markets, one key indicator that often captures their attention is the CBOE Volatility Index, also known as the VIX. This indicator, sometimes referred to as the fear index, measures the market’s expectation of volatility over the next 30 days. When the VIX spikes above 16, as it recently has, it can signal potential shifts in market sentiment and investor behavior.

Understanding the Significance of a VIX Spike Above 16

A VIX level above 16 is generally considered to be above the long-term average. Historically, heightened VIX levels have been associated with increased market volatility and uncertainty, often coinciding with periods of market turbulence or correction. When the VIX spikes above 16, it suggests that investors are anticipating more significant price fluctuations in the near future.

Effects on Investment Strategies

For investors, a spike in the VIX above 16 may prompt a reassessment of their investment strategies. Higher volatility can lead to bigger price swings in the market, making it more challenging to predict and manage risk effectively. In response to an elevated VIX, investors may opt to adjust their asset allocations, increase hedging strategies, or even reduce their exposure to more volatile investments.

Market Sentiment and Investor Behavior

The VIX can also reflect broader market sentiment and investor behavior. A spike above 16 may indicate growing concerns or uncertainty among market participants. Fear and uncertainty can drive investors to become more risk-averse, leading to selling pressure and potential market downturns. It is essential for investors to monitor the VIX closely and consider the broader market environment when making investment decisions.

Market Volatility and Economic Indicators

Market volatility, as measured by the VIX, can be influenced by various factors, including economic indicators, geopolitical events, and corporate earnings. A spike above 16 may coincide with adverse economic news, such as disappointing GDP growth or rising unemployment rates. Geopolitical tensions, trade disputes, or unexpected events can also contribute to heightened market volatility, reflected in a rising VIX.

Risk Management and Preparedness

In conclusion, a spike in the VIX above 16 serves as a reminder of the importance of risk management and preparedness in investing. While market volatility is inevitable, investors can take steps to mitigate risks and protect their portfolios. By staying informed, diversifying their investments, and maintaining a long-term perspective, investors can navigate periods of heightened volatility with greater confidence and resilience.

As market conditions evolve and uncertainty persists, monitoring the VIX and understanding its implications can provide valuable insights for investors seeking to navigate the challenging landscape of the financial markets. By staying informed, remaining vigilant, and adapting their strategies as needed, investors can position themselves for success in the face of changing market dynamics and rising volatility.