The recent volatility in the financial market has sparked concerns among investors and analysts alike. As the stock market continues to fluctuate, many are left wondering if the financials are sending a major warning signal. Let’s delve into the key indicators and trends that are causing these alarm bells to ring.

One major concern that has been raised is the inverted yield curve. This occurs when short-term interest rates surpass long-term rates, a phenomenon that historically signals an impending recession. The current inversion in the yield curve has sent shockwaves through the market, leading many to believe that a recession may be on the horizon.

Another factor contributing to the uncertainty in the financial market is the escalating trade tensions between the United States and China. The ongoing trade war has created a cloud of uncertainty over the global economy, impacting businesses and consumers alike. Investors are closely monitoring the developments in trade negotiations, as any escalation could further destabilize the markets.

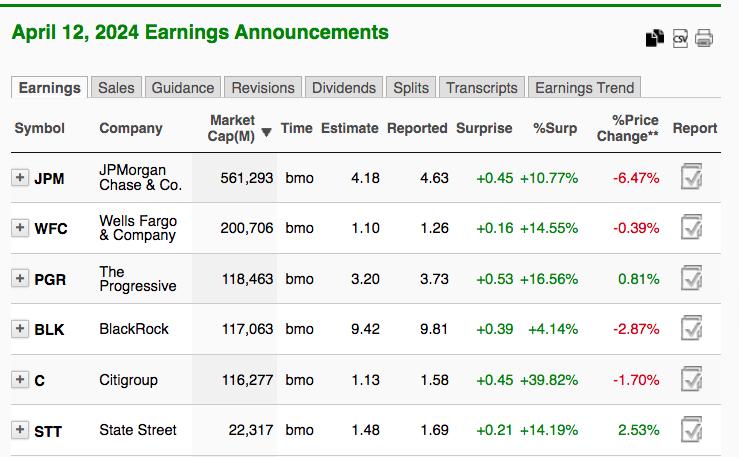

Additionally, corporate earnings have been a cause for concern. Many companies have reported weaker-than-expected earnings, raising questions about the overall health of the economy. Sluggish global growth, rising production costs, and geopolitical tensions have all contributed to the decline in corporate profitability.

Furthermore, the Federal Reserve’s monetary policy decisions have added to the volatility in the market. The Fed’s recent interest rate cuts were aimed at stimulating economic growth; however, they have also raised concerns about the central bank’s ability to navigate uncertain economic conditions. Investors are closely watching the Fed’s next moves to gauge the impact on the market.

In conclusion, the financials are indeed sending a major warning signal, and it is crucial for investors to stay informed and vigilant in such uncertain times. Keeping a close eye on key indicators such as the yield curve, trade tensions, corporate earnings, and monetary policy decisions will be essential in navigating the current market landscape. As always, it is important to stay diversified, exercise caution, and seek professional advice to weather any potential storm on the horizon.