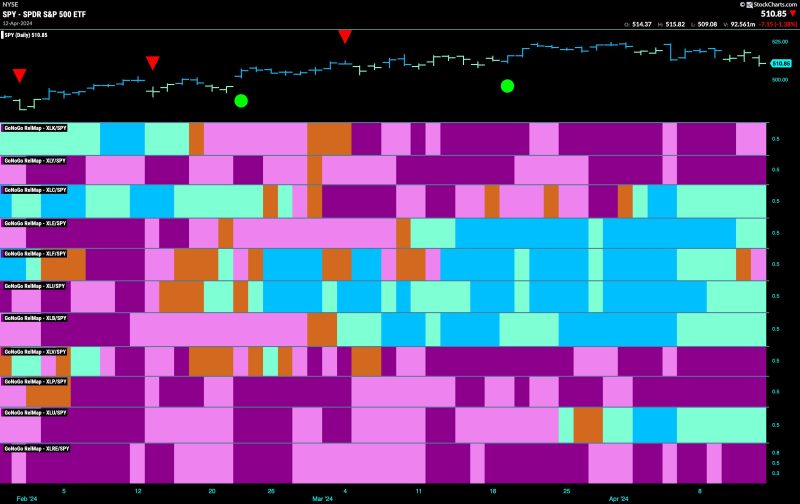

Equity Markets Struggle to Hold Onto Go Trend as Industrials Try to Lead – Apr 15, 2024

The performance of equity markets is a critical indicator of global economic health and investor sentiment. In recent months, markets have been grappling with a range of uncertainties, from geopolitical tensions to supply chain disruptions. The struggle to hold onto a positive trend reflects the underlying challenges facing the global economy and the efforts of key sectors to drive growth.

One of the key trends in recent market movements has been the attempt by industrial companies to lead the way forward. Industrials are a bellwether sector, with their performance often reflecting broader economic trends. As such, their ability to overcome challenges and drive growth is closely watched by investors and analysts alike.

However, the path for industrials has not been without obstacles. Supply chain disruptions, labor shortages, and regulatory uncertainties have all posed challenges for companies in this sector. These challenges have been further exacerbated by broader macroeconomic trends, including rising inflation and interest rates.

Despite these headwinds, industrial companies have shown resilience and adaptability in the face of adversity. Many firms have focused on streamlining operations, improving efficiency, and investing in technology to drive innovation. These efforts have enabled them to weather the storm and position themselves for future growth.

The performance of industrial companies has also been supported by a number of external factors. Government stimulus measures, robust consumer demand, and a gradual easing of supply chain disruptions have all helped to buoy the sector. In addition, the ongoing shift towards sustainable practices and clean energy has opened up new opportunities for industrial companies to diversify their offerings and tap into emerging markets.

Looking ahead, the outlook for industrial companies remains mixed. While challenges persist, there are also reasons for optimism. Continued government support, a rebound in global trade, and ongoing advancements in technology are all potential drivers of growth for the sector. However, companies will need to remain vigilant and agile in order to navigate the evolving economic landscape successfully.

In conclusion, the struggle of equity markets to hold onto a positive trend reflects the broader challenges facing the global economy. Industrial companies have emerged as key players in this environment, with their performance closely watched by investors and analysts. By focusing on innovation, efficiency, and adaptability, these companies have shown resilience in the face of adversity and positioned themselves for future growth. While challenges remain, there are also reasons for optimism, suggesting that industrials may yet succeed in leading equity markets forward.