Investing with the Trend: An Effective Strategy

Understanding market trends is an essential aspect of successful investing. By identifying and following trends, investors can make informed decisions and potentially maximize profits. In this article, we will delve into the concept of investing with the trend and explore its benefits and strategies for implementation.

Benefits of Investing with the Trend

Investing with the trend offers numerous advantages to investors seeking to build a profitable portfolio. One of the key benefits is the ability to capitalize on the momentum of the market. When investors align their investments with the prevailing trend, they are more likely to ride the wave of price movements and generate higher returns.

Additionally, investing with the trend can help investors reduce the risk of losses. By following the direction of the market, investors can avoid going against the prevailing sentiment and minimize the impact of market fluctuations on their portfolios.

Furthermore, investing with the trend promotes a disciplined approach to investing. By focusing on objective criteria such as price movements and market patterns, investors can make more rational and informed decisions, rather than being swayed by emotions or market noise.

Strategies for Investing with the Trend

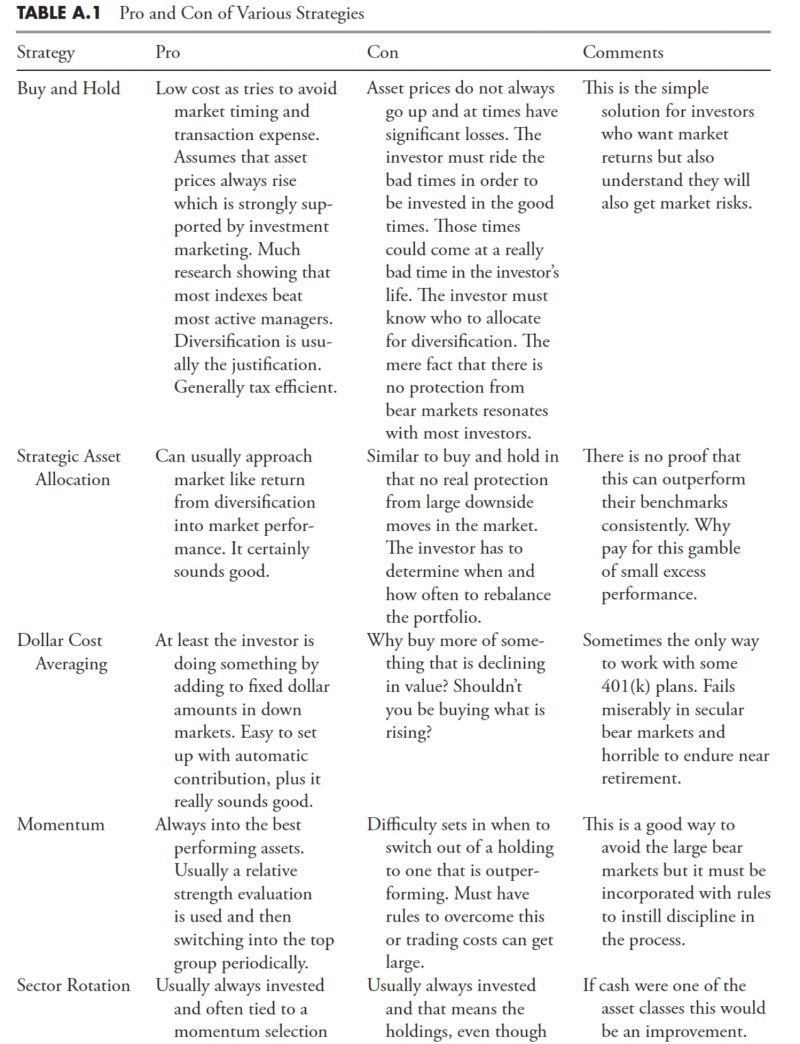

Implementing a successful trend-following strategy requires a structured approach and a thorough understanding of market dynamics. Here are some key strategies that investors can use to invest with the trend effectively:

1. Trend Analysis: Conduct a comprehensive analysis of market trends using technical analysis tools such as moving averages, trend lines, and support/resistance levels. By identifying the prevailing trend, investors can determine the optimal entry and exit points for their investments.

2. Risk Management: Implement risk management techniques such as setting stop-loss orders and position sizing to protect capital and minimize losses. By managing risk effectively, investors can preserve capital during adverse market conditions and maintain a sustainable investing strategy.

3. Diversification: Diversifying the investment portfolio across different asset classes, sectors, and regions can help reduce correlation risk and enhance the resilience of the portfolio to market fluctuations. By spreading investments across a diverse range of assets, investors can mitigate risk and capture opportunities in multiple market environments.

4. Regular Review: Continuously monitor market trends and review the performance of investments to identify any potential changes in market conditions. By staying informed and adapting to evolving trends, investors can adjust their investment strategies accordingly and maximize returns.

In conclusion, investing with the trend is a valuable strategy for investors looking to achieve long-term success in the financial markets. By aligning investments with the prevailing market trends and following a disciplined approach, investors can potentially generate higher returns, reduce risk, and build a resilient portfolio. By incorporating trend-following principles into their investment strategy, investors can enhance their chances of achieving their financial goals and creating wealth over time.