The article at the provided link discusses the Federal Reserve and its impact on the economy. It raises concerns about the actions of the Fed and their potentially negative consequences for the general population. This issue is crucial as the decisions made by the Federal Reserve have far-reaching effects on the financial landscape of the country. By delving deeper into the Federal Reserve’s policies and their implications, we can gain a better understanding of how they shape our economic reality.

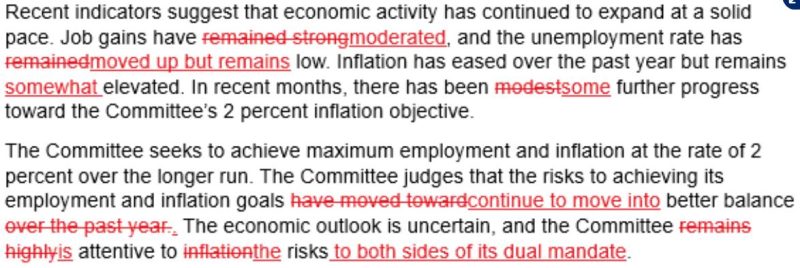

One of the core points made in the article is the idea that the Federal Reserve is creating its own nightmare. This assertion suggests that the actions taken by the Fed, particularly regarding monetary policy and interest rates, may have unintended consequences that could prove detrimental in the long run. The article implies that the Fed’s efforts to control inflation and stabilize the economy may backfire, leading to a situation where the very measures intended to safeguard the economy end up causing harm.

Furthermore, the article paints a grim picture of the relationship between the Federal Reserve and the general public. It characterizes the public as mere puppets, manipulated by the Fed’s policies and decisions. This portrayal underscores the notion that the Fed wields significant power over the economy and, by extension, the lives of everyday citizens. The idea that the Federal Reserve could be acting in a self-serving manner, prioritizing its own interests over those of the populace, is a worrisome prospect that warrants further scrutiny.

In examining the Fed’s role in the economy, it is essential to consider the broader context of monetary policy and its effects. The Federal Reserve plays a pivotal role in influencing interest rates, inflation, and overall economic stability. Its decisions can impact everything from borrowing costs to employment levels, making it a critical player in shaping the economic landscape. However, with great power comes great responsibility, and the Federal Reserve must be held accountable for the consequences of its actions.

It is worth noting that criticism of the Federal Reserve is not new. Over the years, various voices have raised concerns about the Fed’s transparency, accountability, and efficacy in managing the economy. Calls for greater oversight and scrutiny of the institution have been persistent, reflecting a broader sentiment that the Fed’s actions need to be subject to more rigorous evaluation.

In conclusion, the article sheds light on the complex relationship between the Federal Reserve and the economy. By questioning the Fed’s motives and highlighting potential risks associated with its policies, the article prompts readers to consider the implications of central bank actions. Ultimately, a nuanced understanding of the Federal Reserve’s role is essential for navigating the ever-changing economic landscape and advocating for policies that prioritize the well-being of all citizens.