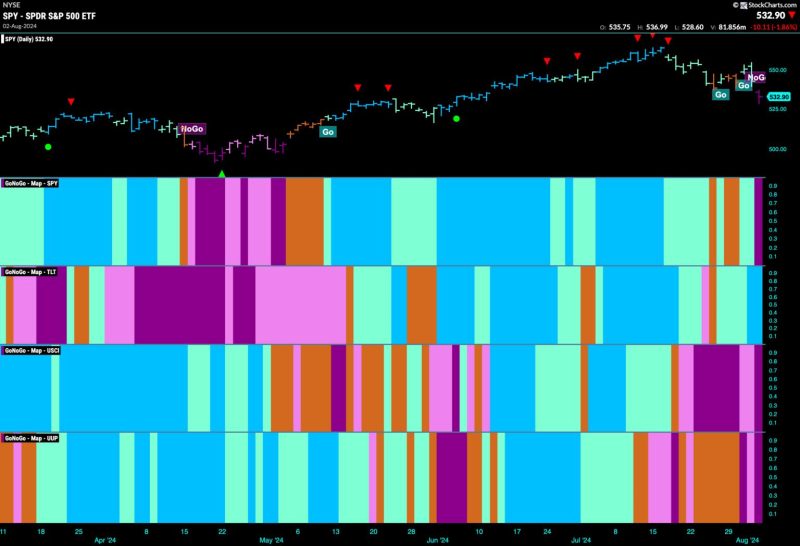

Stocks Get Defensive as Market Index Enters ‘NoGo’ Zone

Stock market investors are facing a challenging environment as the latest data indicate that the market index has entered what is being referred to as the ‘NoGo’ zone. This term, coined by analysts, signifies a period of heightened uncertainty and dwindling investor confidence in the market.

Several factors have contributed to this defensive stance adopted by investors. The ongoing trade tensions between major global economies, particularly the United States and China, have weighed heavily on market sentiment. The constant back-and-forth of tariffs and retaliatory measures has injected a level of unpredictability that investors are finding difficult to navigate.

Additionally, the looming threat of a potential economic recession is casting a shadow over the market. In recent months, key economic indicators have shown signs of weakness, raising concerns that a downturn may be on the horizon. This uncertainty has prompted investors to adopt a defensive strategy and reevaluate their risk exposure in the market.

Amidst this turbulent environment, certain sectors are emerging as defensive plays that are garnering increased interest from investors. Defensive stocks, such as those in the healthcare, consumer staples, and utilities sectors, are traditionally seen as more resilient during economic downturns. These sectors typically offer products and services that are essential, regardless of the economic climate, making them attractive options for risk-averse investors.

Furthermore, dividend-paying stocks are gaining popularity as investors seek stable sources of income amidst the market volatility. Companies that have a consistent track record of paying dividends are seen as providing a reliable income stream, regardless of short-term market fluctuations.

In light of the ‘NoGo’ zone that the market index has entered, investors are advised to exercise caution and consider defensive strategies to safeguard their investments. Diversification, focus on quality stocks, and regular review of investment portfolios are some of the key practices that can help investors weather the storm and navigate through uncertain times.

Ultimately, while the current market environment may be challenging, it also presents opportunities for savvy investors who are able to identify defensive plays and adjust their strategies accordingly. By remaining vigilant and adaptable, investors can position themselves to navigate through the ‘NoGo’ zone and emerge stronger on the other side.