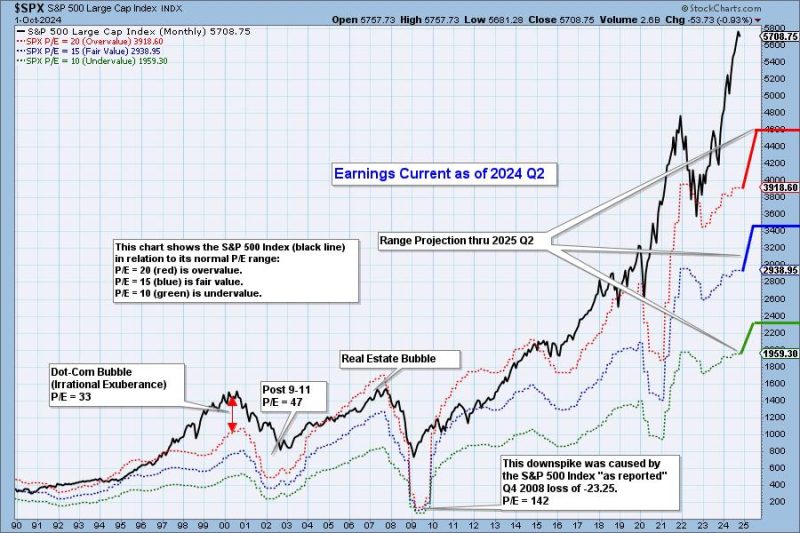

The recent earnings report released for Q2 of 2024 has highlighted some interesting trends in the market. The stock prices have continued on an upward trajectory, leading many financial analysts to express concerns about the overall valuation of the market. Several key factors are contributing to the perceived overvaluation of the market at this point in time.

One of the primary drivers of the inflated market valuations is the persistent low interest rates. With interest rates being kept at historically low levels by central banks, investors have been driven towards equities in search of higher returns. This increased demand for stocks has pushed prices higher, leading to a disconnect between stock prices and underlying fundamentals.

Another factor contributing to the overvaluation of the market is the prevalence of speculative behavior among investors. The rise of meme stocks and the proliferation of social media-driven trading have fueled speculative manias in certain sectors of the market. This speculative fervor has led to extreme valuations for some companies that are not supported by their earnings or growth prospects.

Additionally, the influx of capital from retail investors, fueled by commission-free trading apps and online forums, has further distorted market valuations. The ease of access to trading platforms and the gamification of investing have led to increased market volatility and irrational exuberance among retail traders, contributing to the overvaluation of certain stocks.

Furthermore, the lack of alternative investment opportunities has also played a role in the overvaluation of the stock market. With traditional safe-haven assets such as bonds offering low yields, investors have been pushed towards riskier assets such as stocks in search of higher returns. This increased demand for equities has further inflated stock prices beyond their intrinsic value.

In light of these factors, it is crucial for investors to exercise caution and conduct thorough due diligence before making investment decisions. Diversification, fundamental analysis, and a long-term perspective are essential strategies for navigating the current market environment. While the market may appear overvalued based on certain metrics, there are still opportunities for prudent investors to find value in individual stocks and sectors.

In conclusion, the market remains very overvalued as a result of low interest rates, speculative behavior, retail investor participation, and limited investment alternatives. By staying informed, maintaining a disciplined investment approach, and being selective in their stock choices, investors can navigate the current market conditions and position themselves for long-term success.