As we delve into the week ahead and analyze the latest market moves, it is crucial to maintain a broad perspective and closely monitor key indicators to gauge the overall direction of the market. Among the various indices and trading instruments available, one that demands particular attention is the Nifty, a benchmark index that reflects the performance of the top 50 companies listed on the National Stock Exchange of India.

Market outlooks and forecasts can often be influenced by a combination of fundamental and technical factors. On the fundamental side, economic indicators, corporate earnings reports, government policies, and global market trends play a significant role in shaping market sentiment and investor behavior. The Nifty, being a reflection of the broader market, is heavily impacted by these fundamental variables, and hence, it is essential to stay abreast of news and developments that can potentially move the market.

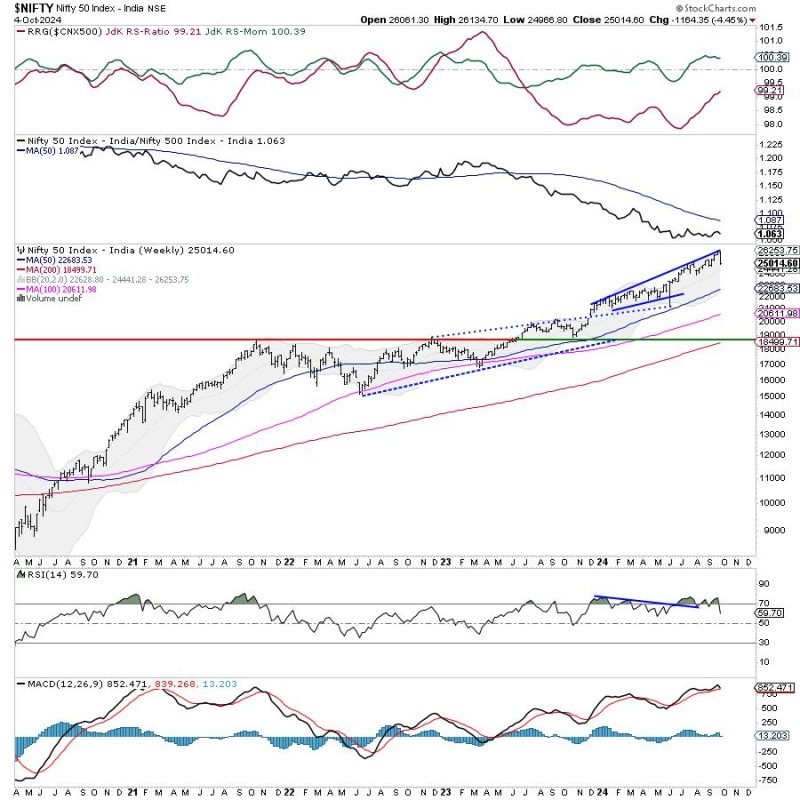

In addition to fundamental analysis, technical analysis also plays a crucial role in understanding market trends and predicting potential price movements. Chart patterns, trend lines, moving averages, and various technical indicators provide valuable insights into market behavior and can assist traders in making informed decisions. The article emphasizes the importance of combining both fundamental and technical analysis to gain a comprehensive understanding of market dynamics.

Risk management is another critical aspect that traders and investors must prioritize. Volatility in the market can lead to sudden price fluctuations, and the ability to manage risk effectively can make a significant difference in preserving capital and achieving sustainable returns. Setting stop-loss orders, diversifying portfolios, and adhering to a disciplined trading plan are some of the strategies that can help mitigate risks and enhance overall performance.

The article underscores the importance of maintaining a disciplined approach to trading and investing. Emotions such as fear and greed can often cloud judgment and lead to impulsive decision-making, which can have adverse consequences on portfolio performance. By adopting a rational and systematic approach based on thorough analysis and risk management, traders can increase their chances of success in the market.

Looking ahead, the article recommends keeping a watchful eye on the Nifty index and monitoring key support and resistance levels to identify potential entry and exit points. By staying informed, leveraging both fundamental and technical analysis, and managing risks effectively, traders can navigate the complexities of the market with confidence and strive for long-term success.