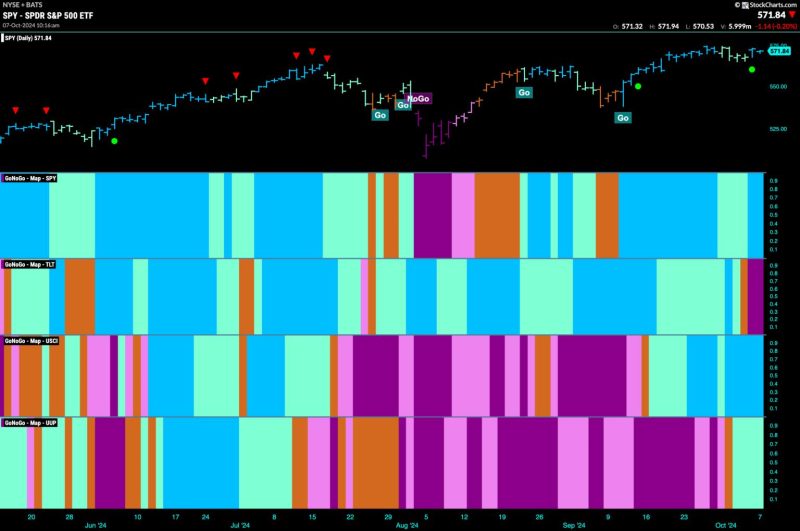

Equities Remain in Go Trend and Lean into Energy

As the global economy continues to recover from the challenges posed by the ongoing COVID-19 pandemic, equities have been displaying resilience and staying in the go trend zone. This trend is particularly evident in the energy sector, where market dynamics and investor sentiment are leaning in favor of energy-related equities.

One key driver behind the current strength of equities is the increasing demand for energy as economic activities resume and global supply chains regain momentum. As countries worldwide shift towards a post-pandemic recovery phase, the need for energy sources to power industries, transportation, and households has been on the rise. This has created a favorable environment for energy companies, leading to an uptick in their stock prices and valuations.

Furthermore, the commitment to sustainability and clean energy initiatives has also played a significant role in driving investor interest towards energy equities. With a growing emphasis on environmental responsibility and reducing carbon footprint, many energy companies are focusing on renewable energy sources and adopting more eco-friendly practices. This shift towards sustainability has attracted a new wave of investors who are looking for opportunities in the energy sector that align with their values and long-term goals.

In addition to the demand-side factors, supply constraints and geopolitical tensions have also contributed to the positive outlook for energy equities. Ongoing geopolitical conflicts in key oil-producing regions have raised concerns about potential disruptions to the global energy supply chain, leading to increased volatility in energy markets. This uncertainty has prompted investors to seek refuge in energy stocks as a safe-haven investment, providing further support to the overall bullish trend in equities.

While the current environment appears favorable for energy equities, investors should remain cautious and mindful of potential risks and uncertainties that could impact the sector. Regulatory changes, technological advancements, and shifts in consumer preferences are just some of the factors that could influence the future prospects of energy companies. It is crucial for investors to conduct thorough research, diversify their portfolios, and stay informed about market developments to make well-informed investment decisions.

In conclusion, equities remain in the go trend zone, with energy-related stocks emerging as attractive investment opportunities in the current economic landscape. The strong demand for energy, growing focus on sustainability, and geopolitical factors are all contributing to the positive momentum in the sector. However, investors should exercise prudence and stay vigilant in navigating potential risks and uncertainties that could impact the performance of energy equities in the future. By staying informed and adopting a strategic investment approach, investors can capitalize on the opportunities presented by the current market trends and position themselves for long-term success.