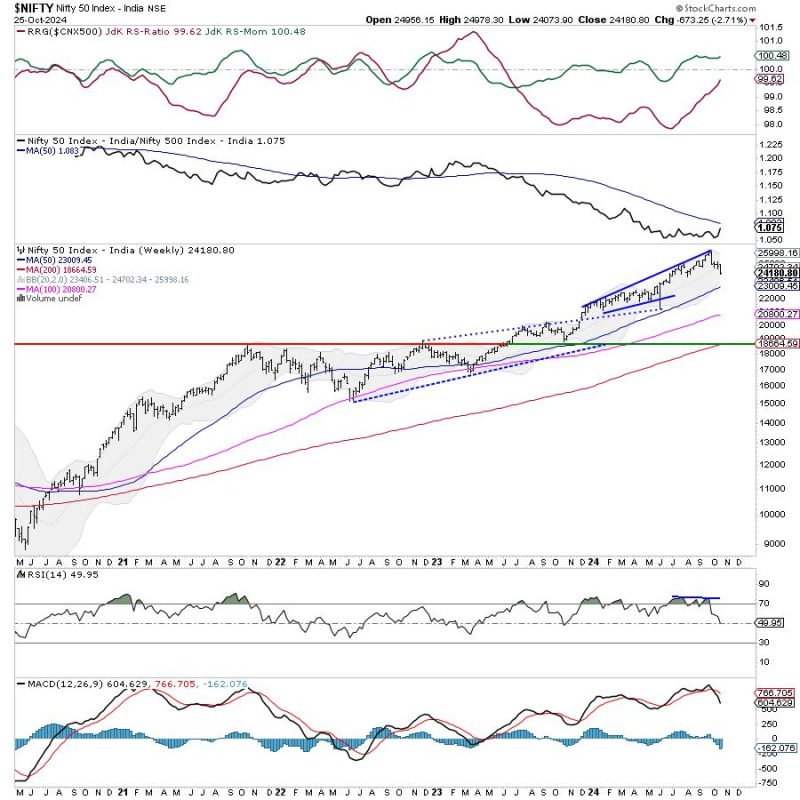

In the stock market, understanding key support and resistance levels is crucial for successful trading. Support levels act as a floor for stock prices, while resistance levels act as a ceiling. When these levels are breached, it can signal a shift in market sentiment and potential changes in the direction of stock prices. Recently, the Nifty index violated key support levels, leading to a drag on resistance levels.

Technical analysis plays a significant role in identifying these support and resistance levels. Traders use various tools and indicators to analyze past price movements and predict future price action. By studying charts and patterns, traders can anticipate potential price reversals and make informed trading decisions.

When a stock price breaks below a support level, it indicates increased selling pressure and a potential shift towards lower prices. In the case of the Nifty index, the violation of key support levels has led to a downward trend, dragging resistance levels lower in the process. Traders are closely monitoring these levels to gauge market sentiment and adjust their trading strategies accordingly.

It is essential for traders to stay informed about market developments and adapt to changing conditions. By closely monitoring support and resistance levels, traders can better position themselves to capitalize on market opportunities and manage risks effectively. The ability to interpret market data and make informed decisions is crucial for success in the world of trading.