The recent turbulence in global financial markets has left investors on edge, with many bracing for a barrage of potentially market-moving news in the coming week. Analysts are pointing to a short-term bearish signal as stock markets grapple with a slew of uncertainties and risk factors. Against this backdrop, traders and investors are closely monitoring key events and developments that could shape market sentiment and direction in the near term.

One of the key factors contributing to the current bearish outlook is the ongoing uncertainty surrounding the trade conflict between the United States and China. The prolonged trade dispute between the world’s two largest economies has rattled global markets and raised concerns about the impact on economic growth. Investors are awaiting further developments on this front, as any signs of escalating tensions could trigger a fresh wave of selling in the equity markets.

In addition to the trade tensions, geopolitical risks are also looming large on the horizon. The situation in the Middle East remains tense, with recent attacks on oil tankers in the Gulf of Oman further stoking fears of regional instability. Any escalation of conflict in the region could have far-reaching implications for energy markets and global economic stability, adding to the market’s overall bearish sentiment.

On the economic data front, investors are bracing for a deluge of key reports and indicators that could provide further insight into the health of the global economy. In the coming week, market participants will be closely watching for updates on key economic indicators such as manufacturing data, employment figures, and consumer sentiment surveys. Any signs of weakness in these areas could fuel concerns about a potential slowdown in economic growth, contributing to the bearish undertone in the markets.

Another factor adding to the short-term bearish signal is the uncertainty surrounding monetary policy. With central banks around the world grappling with the challenge of balancing growth and inflation, investors are eagerly awaiting the outcome of key central bank meetings and policy announcements. The decisions and statements from major central banks, including the Federal Reserve and the European Central Bank, could have a profound impact on market sentiment and direction in the near term.

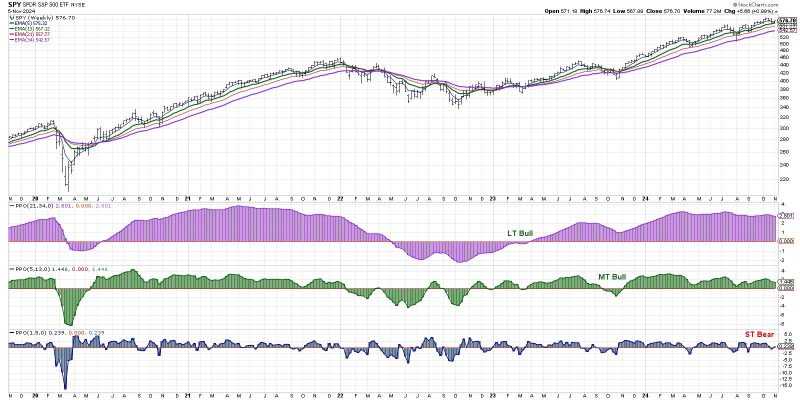

In conclusion, the current market environment is characterized by a short-term bearish signal as investors navigate a challenging landscape of uncertainties and risk factors. From trade tensions and geopolitical risks to economic data and monetary policy developments, there are a multitude of factors weighing on market sentiment. Traders and investors will need to remain vigilant and adaptable in the face of evolving market dynamics, staying attuned to key events and developments that could shape market direction in the days ahead.