Certainly! Here is a well-structured and unique article following the reference link provided:

—

Tin stocks have been gaining attention from investors due to various factors that may influence their value in the market. The demand for tin, a versatile metal used in a wide range of industries, has been steadily increasing, creating opportunities for those looking to invest in this commodity. Investing in tin stocks requires a strategic approach and careful consideration of market trends and the overall economic outlook. In this article, we will explore the key steps to effectively invest in tin stocks in 2024.

Understand the Tin Market Landscape:

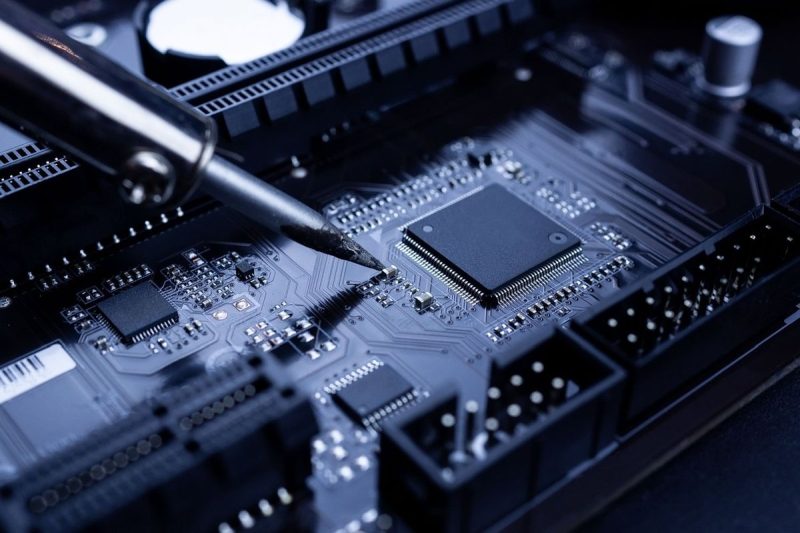

Before diving into investing in tin stocks, it is essential to gain a thorough understanding of the global tin market landscape. Consider factors such as the current supply and demand dynamics, production trends, and price forecasts. Tin is primarily used in industries such as electronics, automotive, and construction, making it a crucial metal in various sectors. Monitoring these industries and their growth prospects can provide valuable insights into the future demand for tin.

Research Tin Mining Companies:

When considering investing in tin stocks, conducting thorough research on tin mining companies is essential. Look for companies with a strong track record in tin production, stable financial performance, and promising growth potential. Additionally, pay attention to factors such as mining locations, production costs, and reserves to assess the company’s long-term viability. Some well-known tin mining companies include PT Timah (Indonesia), Minsur (Peru), and Yunnan Tin Group (China).

Evaluate Market Trends and Price Fluctuations:

Keeping an eye on market trends and price fluctuations is crucial when investing in tin stocks. Tin prices can be influenced by factors such as global economic conditions, geopolitical events, and supply disruptions. By staying informed about these developments, investors can make informed decisions about when to buy or sell tin stocks. Utilize financial news sources, market reports, and industry publications to stay updated on the latest developments in the tin market.

Consider Investing in Tin ETFs or Mutual Funds:

For investors looking for a diversified approach to investing in tin, consider investing in tin exchange-traded funds (ETFs) or mutual funds that focus on metals and mining industries. These investment vehicles offer exposure to a portfolio of tin mining companies, providing diversification and reducing individual company risk. Additionally, ETFs and mutual funds often have lower barriers to entry compared to investing directly in individual tin stocks.

Stay Updated on Regulatory Changes and Environmental Considerations:

In the mining industry, regulatory changes and environmental considerations can significantly impact the operations and profitability of tin mining companies. Stay informed about regulatory developments regarding mining practices, environmental standards, and community relations in tin-producing regions. Companies that adhere to sustainable mining practices and environmental regulations may be better positioned for long-term success and profitability.

Diversify Your Investment Portfolio:

As with any investment strategy, diversification is key to managing risk and maximizing returns. Consider diversifying your investment portfolio by including a mix of tin stocks, other metals, and non-metal assets. By spreading your investments across different sectors and asset classes, you can reduce the impact of market fluctuations on your overall portfolio performance.

In conclusion, investing in tin stocks requires a comprehensive understanding of the tin market landscape, diligent research on tin mining companies, and staying informed about market trends and regulatory developments. By following these key steps and maintaining a diversified investment portfolio, investors can position themselves strategically to capitalize on the potential opportunities in the tin market in 2024 and beyond.

—

I hope you find this article informative and engaging! Let me know if you need further assistance.