Market Research and Analysis: Unveiling the Power of Technical Analysis

Technical analysis stands tall as a crucial tool in the world of market research and analysis. By delving into the intricate details of price movements, volume, and historical data, technical analysis provides valuable insights that can guide investment decisions and forecast future market trends. As investors navigate the complex world of financial markets, understanding the significance of technical analysis is paramount to success.

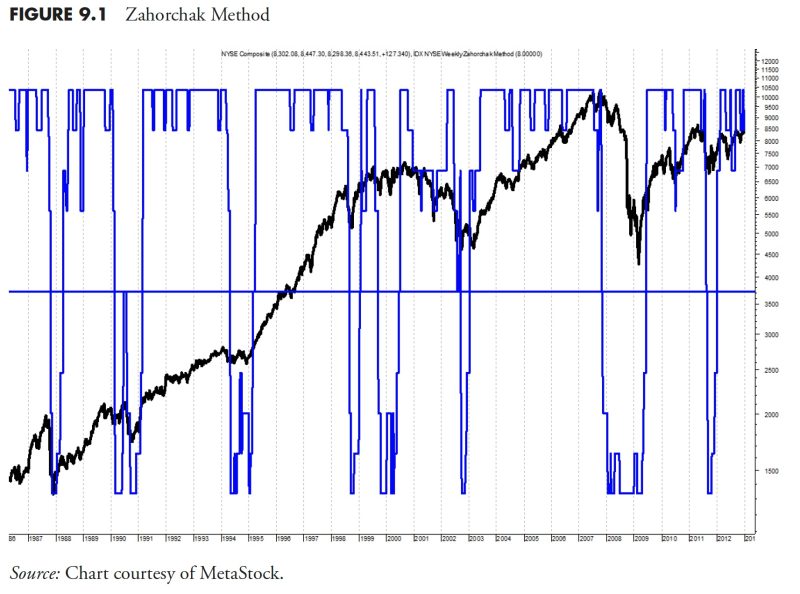

One of the key elements of technical analysis is charting. Charts serve as the visual representation of price movements over a specific period, allowing analysts to identify patterns and trends that shape market behavior. By scrutinizing these charts, analysts can detect important levels of support and resistance, as well as key reversal points. This knowledge empowers investors to make informed decisions on when to enter or exit trades, maximizing potential gains and minimizing risks.

Moreover, technical analysis enables investors to gauge market sentiment. By examining indicators such as moving averages, relative strength index (RSI), and stochastic oscillators, analysts can assess whether a market is overbought or oversold. This information is invaluable in determining the optimal timing for buying or selling assets, helping investors capitalize on opportunities and avoid costly pitfalls.

Another essential aspect of technical analysis is its emphasis on historical data. By studying past price movements and patterns, analysts can identify recurring trends and formations that may indicate future market movements. This historical perspective provides investors with a well-rounded understanding of market dynamics, allowing them to anticipate potential price actions and make informed decisions.

Beyond individual assets, technical analysis can also be applied to market indices and sectors. By analyzing the collective performance of specific industries or market segments, investors can gain valuable insights into broader market trends. This macro perspective enhances decision-making capabilities and enables investors to align their strategies with evolving market conditions.

In conclusion, technical analysis serves as a powerful tool in the realm of market research and analysis. By leveraging charting techniques, market sentiment indicators, and historical data, investors can gain a comprehensive understanding of market dynamics and make informed investment decisions. As the financial markets continue to evolve, the importance of technical analysis in guiding investment strategies cannot be overstated. Embracing this analytical approach can empower investors to navigate the complexities of the market landscape and achieve their financial goals.